Razorpay Success Story: 5 Strategic Lessons for Every Entrepreneur

Vivek Goel

May 12, 2025

Table of Contents

Introduction

In the rapidly evolving fintech ecosystem of India, Razorpay has established itself as a true disruptor—reshaping how businesses accept and manage digital payments. At a time when the Indian startup ecosystem was beginning to gain momentum, one critical hurdle remained unsolved: making online payments simple, reliable, and developer-friendly for businesses of all sizes. Founded in 2014 by Harshil Mathur and Shashank Kumar, two IIT Roorkee graduates, Razorpay was born out of this clear and pressing need.

Back then, integrating payment gateways into a website or app was a tedious process. Businesses had to go through complex documentation, opaque onboarding procedures, and lengthy approval timelines. Most gateways were built for large enterprises and lacked the agility that startups and SMEs required. Recognizing this inefficiency, the Razorpay founders envisioned a modern payment infrastructure—a product that could be integrated with just a few lines of code, backed by clean APIs, and supported with real-time customer service. Their vision was simple but powerful: democratize digital payments for every business in India, no matter how small.

“We realized that most online payment gateway solutions were extremely cumbersome to get started on, especially for start-ups and small- and medium-sized enterprises.”

— Harshil Mathur, Co-founder & CEO, Razorpay

The duo started Razorpay with a single-minded mission—to enable businesses to accept, process, and disburse payments seamlessly through a unified platform. What began as a payment gateway solution quickly evolved into a full-stack financial ecosystem, offering everything from payment links, subscriptions, and invoicing to neo-banking and credit services. By 2023, Razorpay was not only the go-to solution for over 10 million businesses, including brands like Facebook, Airtel, and Swiggy, but also a leading voice in India’s fintech transformation.

Backed by global investors such as Tiger Global, Sequoia Capital, and Y Combinator, Razorpay became one of India’s fastest fintech unicorns, achieving a valuation of $7.5 billion by late 2021. Yet beyond the numbers, it is the company’s unwavering focus on solving real customer pain points with elegance and efficiency that makes Razorpay’s success story truly remarkable.

Origin Story

The inception of Razorpay traces back to a moment of deep frustration — not with innovation, but with the lack of it. While working on a crowdfunding platform, Harshil Mathur and Shashank Kumar repeatedly ran into a critical bottleneck: integrating online payments in India was unnecessarily complex, especially for startups and small businesses.

Most payment gateways had outdated interfaces, long approval processes, and rigid systems designed only for large enterprises. For early-stage founders like them, this inefficiency wasn’t just inconvenient — it was a serious roadblock to scaling digital-first ventures.

Sensing a gap in the market, Harshil and Shashank envisioned a clean, developer-first payment gateway that would be easy to integrate, fast to onboard, and tailored to the evolving needs of India’s startup ecosystem. That idea laid the foundation for Razorpay in 2014. With a clear mission to simplify digital payments in India, they built an MVP and applied to Y Combinator, the renowned Silicon Valley accelerator. Their acceptance into Y Combinator was a turning point. It gave them both validation and mentorship, helping them fine-tune their product and scale quickly.

But the road to success wasn’t smooth. Razorpay faced rejection after rejection — over 100 banks and investors turned them down. Many questioned the viability of a fintech startup founded by two engineers with no prior banking experience. But Harshil and Shashank remained undeterred. Their technical background allowed them to build faster, adapt better, and approach problems with a fresh mindset.

Their breakthrough came when one bank finally agreed to give them a chance. With that partnership, Razorpay went live and never looked back. What began as a response to a broken system quickly evolved into a movement to reimagine fintech in India.

“The question was not, ‘how many players are there?’ The question is, ‘are they solving the need in the market?’” — Harshil Mathur, Co-founder & CEO, Razorpay

Business Landscape and Challenges

When Razorpay entered the Indian fintech space in 2014, it was venturing into a fiercely competitive and highly regulated market. Established players like BillDesk, CCAvenue, and PayU had already captured significant market share, and banks traditionally dominated digital payment channels.

For a young startup run by first-time founders without prior experience in banking or finance, the odds seemed stacked against them. The primary challenge wasn’t just about building a product — it was about earning the trust of businesses in a space where reliability and security are paramount.

Moreover, the regulatory landscape for digital payments in India was (and continues to be) in constant flux. New compliance mandates from the Reserve Bank of India (RBI), evolving norms around KYC, data protection, and payment settlement cycles meant that Razorpay had to continuously stay ahead of the curve to maintain credibility. Navigating these rules while remaining agile and innovative was no easy task.

Razorpay also faced a fundamental challenge: convincing startups and enterprises to shift from legacy systems to a newer, less-known player. This required more than a sales pitch — it demanded exceptional service delivery, robust tech infrastructure, and a customer-first philosophy. To build trust, Razorpay emphasized complete transparency in its pricing and operations, quick onboarding times, and responsive customer support — features that were sorely lacking in the market at the time.

Rather than trying to outspend the incumbents on marketing, Razorpay invested deeply in product excellence. They worked closely with early adopters to refine their offerings, iron out bugs, and co-create features. Their API-first approach and clean documentation became a major selling point for developers — the true decision-makers in fast-moving startups.

Through a relentless commitment to problem-solving and user experience, Razorpay gradually shifted the conversation from “Who are you?” to “How can we use more of your products?”

“Success comes to those who never give up and always keep innovating.”

— Harshil Mathur, Co-founder & CEO, Razorpay

Growth Strategies

Razorpay’s rapid ascent in the Indian fintech ecosystem was no accident — it was the result of carefully orchestrated strategies that addressed both the technical and emotional needs of modern businesses. One of their earliest and most defining moves was embracing a developer-first approach.

Harshil Mathur and Shashank Kumar, both engineers themselves, recognized the pain developers experienced while integrating payment gateways. Razorpay made it radically easier with clean APIs, detailed documentation, and sandbox environments. This lowered the barrier to adoption significantly, allowing even early-stage startups to implement digital payments with minimal friction.

“We wanted to make payments as easy as integrating a few lines of code.”

— Shashank Kumar, Co-founder & CTO, Razorpay

But Razorpay wasn’t content with just owning the payment gateway space. As they deepened their understanding of customer needs, they launched a broader financial services stack. Products like RazorpayX, a full-fledged neo-banking platform, allowed businesses to manage payroll, vendor payments, and expense cards from a single dashboard. Meanwhile, Razorpay Capital addressed the chronic issue of access to credit for SMEs by offering quick, collateral-free working capital loans. This expansion into adjacent services created a sticky ecosystem where users found value in staying within the Razorpay umbrella.

Their ambition to build a comprehensive fintech suite was further accelerated through strategic acquisitions. A notable move was acquiring Malaysian fintech startup Curlec, enabling Razorpay to expand its operations into Southeast Asia and access new demographics. These acquisitions were not just geographic expansions — they brought in new technologies, fresh talent, and innovative ideas that fed into Razorpay’s growth engine.

Another cornerstone of their success was customer-centric innovation. Razorpay maintained close feedback loops with its users, regularly updating and optimizing its offerings based on real-world inputs. This iterative development process ensured the platform remained responsive and relevant to the evolving expectations of its diverse user base — from startups to large enterprises.

Finally, in an industry as tightly regulated as fintech, proactive compliance became a competitive advantage. Razorpay engaged constructively with regulators and quickly adapted to new norms, whether it involved RBI guidelines, data localization laws, or fraud detection protocols. This dedication to governance and integrity helped the company earn the trust of businesses, banks, and investors alike — a priceless asset in the digital payments space.

Marketing Strategy

Razorpay’s marketing approach was never about loud advertisements or celebrity endorsements. Instead, it was rooted in authenticity, education, and community-building — all designed to add value before extracting it. One of the pillars of their marketing strategy was content marketing.

Razorpay invested heavily in producing high-quality, insightful content across multiple formats — from in-depth blog articles on fintech trends to instructional videos, product demos, and live webinars. These resources not only educated their audience but also positioned Razorpay as a thought leader in the digital payments ecosystem. Startups and developers began to rely on Razorpay not just as a service provider but as a source of trusted knowledge.

Another key pillar of their outreach was community engagement. Razorpay actively participated in tech conferences, hackathons, and startup events across India. This visibility in the startup and developer ecosystem allowed them to build genuine relationships with potential clients, partners, and even future employees. Their co-founders often spoke at industry events and on podcasts, giving aspiring entrepreneurs and developers direct insight into Razorpay’s journey and vision. This consistent presence created a sense of familiarity and trust around the brand.

In addition, customer advocacy played a pivotal role in Razorpay’s organic growth. They regularly highlighted the stories of businesses that successfully scaled using Razorpay’s platform — whether through faster payment collections, simplified financial operations, or access to capital. These customer testimonials served as social proof and demonstrated real-world impact, helping prospective users see how Razorpay could solve their specific problems. In an industry where trust is paramount, showcasing these success stories significantly boosted their credibility.

Razorpay’s understated yet strategic marketing efforts helped them create a brand that was not only well-recognized but also deeply respected. They didn’t chase attention — they earned it through relevance, reliability, and community-led growth.

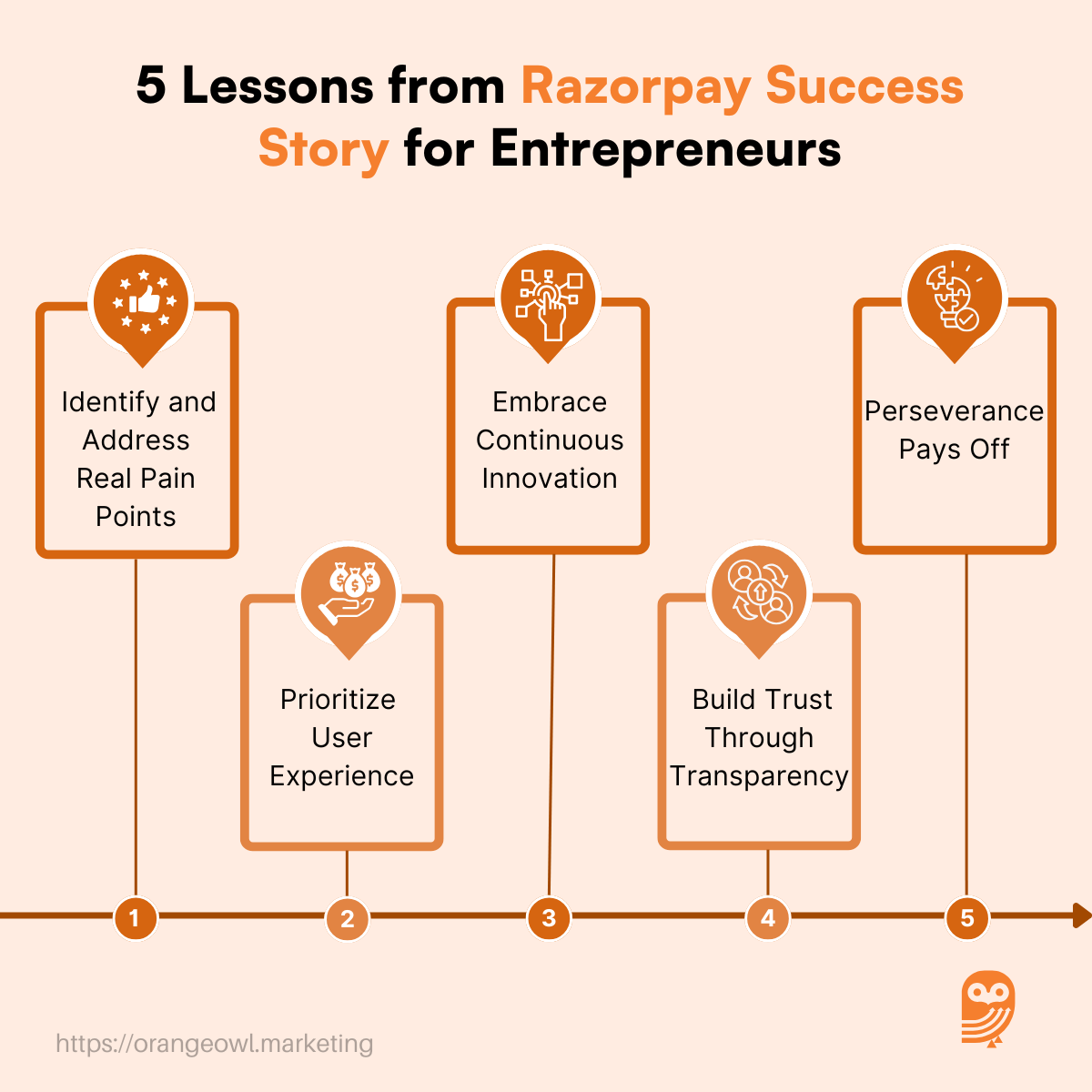

5 Strategic Lessons for Every Entrepreneur

1. Identify and Address Real Pain Points

Razorpay’s success can be directly attributed to its focus on solving a real pain point in the market. The founders, Harshil Mathur and Shashank Kumar, were acutely aware of the fragmented and cumbersome nature of online payment solutions in India.

By creating a platform that streamlined payment processes and made them accessible to small and medium-sized businesses, Razorpay tapped into a market that was often underserved by traditional financial institutions. For entrepreneurs, the lesson is clear: always start by understanding your audience’s deepest pain points and then work relentlessly to address them. Problem-solving at its core is what will set your venture apart from others in the market.

2. Prioritize User Experience

In a space as competitive as fintech, a seamless user experience is crucial for gaining and retaining customers. Razorpay’s platform wasn’t just functional; it was designed with the user in mind. Whether it was easy integration for developers or a straightforward UI for business owners, Razorpay ensured that every interaction with the platform was simple and hassle-free.

In today’s competitive market, user experience can be a key differentiator. Entrepreneurs must focus on delivering a product that feels intuitive, doesn’t frustrate users, and provides real value right from the first interaction. A positive user experience encourages not only initial adoption but long-term customer loyalty.

3. Embrace Continuous Innovation

Razorpay’s story underscores the importance of innovation. While it started with a simple payment gateway, Razorpay quickly diversified its product suite by launching RazorpayX (a neo-banking platform) and Razorpay Capital (providing working capital loans). This ability to evolve with market needs and introduce relevant products has been a core driver of their success.

Entrepreneurs should learn to remain agile and embrace innovation as an ongoing process. The business environment changes constantly, and to stay ahead, you must continuously innovate and create products or services that address the ever-evolving needs of your customers.

4. Build Trust Through Transparency

In the fintech space, trust is everything. Razorpay’s commitment to transparency in both its operations and interactions with customers has been fundamental to its success. From clear pricing structures to transparent communication regarding compliance, Razorpay ensured that customers knew they were partnering with a reliable, trustworthy company.

Entrepreneurs in all industries should follow this example and prioritize transparency in their dealings. Trust is built over time, and customers are more likely to stay loyal to a brand that demonstrates honesty and integrity, especially in high-stakes industries like finance.

5. Perseverance Pays Off

Razorpay’s journey wasn’t without its challenges. The founders faced numerous rejections from investors and financial institutions, but their resilience never wavered. Rather than letting setbacks define them, they used each rejection as an opportunity to refine their approach and improve their product. Their unwavering commitment to their vision ultimately paid off, leading Razorpay to become one of India’s leading fintech companies.

For entrepreneurs, the lesson here is clear: the road to success is never linear. Setbacks and failures are part of the journey, but perseverance and determination will eventually lead to success. Keep pushing forward and always look for ways to learn from your challenges.

“We always asked — what’s the next big pain we can solve for our customer?”

— Harshil Mathur, Co-founder & CEO, Razorpay

Conclusion: Key Takeaways from Razorpay’s Journey

Razorpay’s remarkable journey from a fledgling startup facing numerous challenges to becoming a fintech unicorn is a testament to the power of vision, resilience, and customer-centric innovation. What started as a simple idea to streamline online payments in India has blossomed into one of the most successful fintech companies in the country. Razorpay’s story highlights several key lessons that are crucial for entrepreneurs seeking to make their mark in any industry.

Razorpay’s journey illustrates that success doesn’t come overnight, and it is rarely a smooth ride. Founders Harshil Mathur and Shashank Kumar faced over 100 rejections from banks and investors before gaining traction, yet they remained relentless in their pursuit. Their ability to push forward, despite adversity, underscores an essential truth for entrepreneurs: resilience is often the key to overcoming obstacles and emerging stronger. Razorpay’s story is a powerful reminder that challenges are part of the entrepreneurial journey, and with the right mindset, these challenges can be turned into stepping stones toward success.

A significant element of Razorpay’s success has been their deep understanding of market needs and their focus on creating products that truly solve real problems. Entrepreneurs must ensure their solutions are relevant and impactful for their target audience. Razorpay took the time to listen to their customers, learn from their feedback, and continuously evolve their product offering. They didn’t just build a payment gateway; they built an entire suite of solutions that catered to the diverse needs of businesses, from payment processing to neo-banking and working capital loans. By staying deeply attuned to the needs of their users, Razorpay was able to create solutions that were not just functional, but transformative for businesses across India.

Finally, the story of Razorpay reinforces the timeless entrepreneurial lesson: perseverance pays off. Harshil and Shashank’s journey was filled with rejection, doubt, and setbacks, but their belief in their vision and their commitment to their customers never wavered. Entrepreneurs should recognize that success doesn’t come instantly and that resilience, perseverance, and a long-term outlook are key factors in achieving success.