Mensa Brand Success Story: 5 Innovative Lessons for Every Entrepreneur

Vivek Goel

June 11, 2025

Table of Contents

Introduction

In 2021, Ananth Narayanan—former CEO of Myntra and Medlife—embarked on a bold mission to build India’s version of Thrasio: a house of brands that could acquire, scale, and digitally optimise profitable D2C businesses. Thus was born Mensa Brands, a startup with a singular goal—to transform India’s most promising yet under-leveraged consumer brands into global powerhouses by fusing operational excellence with tech-enabled scale.

At the time, many D2C founders faced a common set of challenges: scaling beyond ₹50–100 crore in revenue, optimising digital distribution, and managing everything from supply chains to customer experience. Mensa positioned itself as the perfect partner, not just acquiring these brands, but accelerating them. Unlike private equity firms focused on short-term ROI, Mensa promised long-term brand-building, deep operational collaboration, and access to a playbook refined by Ananth’s years at the helm of top consumer platforms.

By bringing together data science, performance marketing, supply chain expertise, and global distribution channels under one roof, Mensa created a platform that could turn digital-first brands into household names, both in India and globally. Within just six months of launch, the company achieved unicorn status in 2021, becoming one of the fastest Indian startups to do so. Today, Mensa Brands is valued at $1.2 billion, a testament to its disruptive model and sharp execution.

The Mensa Brand’s success story is a masterclass in how vision, speed, and strategic acquisitions can reshape the future of e-commerce in India.

Origin Story

Before founding Mensa Brands, Ananth Narayanan had already built a reputation as a scale-up expert. At Myntra, he led the company during its hyper-growth phase, and later steered Medlife into one of India’s early healthtech success stories. But amid all this, a recurring pattern caught his attention: India had no shortage of promising D2C brands, but most struggled to scale beyond a point.

These founders had strong products and loyal customer bases but lacked the tools to grow beyond a niche. As Ananth put it,

“India has thousands of amazing entrepreneurs building small, profitable brands. But they need help to scale—be it in digital marketing, technology, or supply chains.”

This sparked the idea for Mensa Brands, founded in May 2021, with a mission to partner with digital-first brands and accelerate their growth using a tech-enabled, centralised platform. The name “Mensa” (Latin for “table”) captured this spirit of collaboration. Ananth explained:

“We don’t replace founders. We bring them to the table and supercharge their journey.”

The model, similar to that of US-based Thrasio, was customised for Indian market dynamics, from inventory-heavy logistics to price-sensitive consumer behaviour. Mensa’s strategy focused on acquiring high-margin, digital-first brands across categories like fashion, home, beauty, and personal care, and scaling them aggressively across marketplaces, international channels, and owned D2C websites.

Backed by Accel, Tiger Global, Falcon Edge, and Norwest, Mensa raised $50M in one of India’s largest seed rounds, signaling strong investor conviction. By the end of its first year, the startup had already acquired over a dozen brands—like Dennis Lingo, MyFitness, and Villain—and was turning them into household names.

Ananth’s pitch was simple yet powerful:

“We’re building a House of Brands for the digital age—one that’s agile, tech-enabled, and founder-friendly.”

The origin story of Mensa Brands is a case study in leveraging operating experience, founder empathy, and capital efficiency to create a modern-day consumer powerhouse—where scale meets substance, and growth is engineered, not just expected.

Business Landscape and Challenges

When Mensa Brands entered the market in 2021, the Indian D2C (direct-to-consumer) segment was booming but fragmented. E-commerce has lowered the barriers for brand creation, leading to the rise of thousands of niche online-first labels in categories like fashion, beauty, home decor, and wellness. However, scaling these brands beyond ₹10–20 crore in annual revenue remained an uphill task.

While the opportunity was massive—India’s online retail market was projected to cross $100B by 2025—most emerging brands lacked the capital, talent, and infrastructure to scale nationally or globally. This gap represented a massive whitespace for Mensa to step in.

As Ananth Narayanan observed:

“Brand building is not just about storytelling anymore. It’s about supply chains, tech, analytics, and deep consumer insight. That’s where most young brands struggle—and where Mensa comes in.”

Yet, the early path wasn’t without challenges:

- Fragmented Supply Chains: Many acquired brands had rudimentary logistics, inconsistent quality, or hyper-local sourcing models. Mensa had to rebuild supply chains at scale while preserving brand identity.

- Tech Integration: Mensa envisioned a data-driven backend that could plug into each brand and drive performance. But merging legacy systems across brands into a single tech stack required intensive reengineering.

- Cultural Fit with Founders: Unlike a traditional acquisition house, Mensa positioned itself as a partner, not a buyer. But winning the trust of founders—and retaining them post-acquisition—meant balancing control with collaboration.

- Execution at Speed: In a space where global competitors like Thrasio were already scaling fast, Mensa had to prove that its model could work in India’s diverse, price-sensitive, and mobile-first market.

Still, Mensa turned these obstacles into differentiators by creating centralised centres of excellence for marketing, technology, finance, and operations, allowing brand founders to focus on vision and innovation, while Mensa accelerated everything else.

Narayanan summed it up best: “Our thesis was clear—there’s no shortage of great brands in India. What’s missing is a growth engine. Mensa is that engine.”

By redefining how consumer brands are scaled in India, Mensa Brands didn’t just enter a market—it started rewriting the rules.

Growth Strategies

Mensa Brands didn’t just acquire promising D2C labels—it built a scalable growth engine that could 10x their potential in record time. At the heart of Mensa’s strategy was a disciplined focus on tech-led brand scaling, operational excellence, and global expansion.

One of Mensa’s first strategic moves was creating category-focused growth pods—dedicated teams with deep expertise in specific verticals like fashion, beauty, home, and personal care. These pods worked hand-in-hand with brand founders to diagnose bottlenecks, unlock efficiencies, and launch new product lines at speed.

But Mensa’s true edge came from its tech-first operating model. The company built a robust backend powered by advanced analytics and automation, enabling it to:

- Optimise ad spends across digital channels

- Predict demand using real-time data

- Streamline inventory management

- Personalise the customer journey at scale

As Ananth Narayanan emphasised:

“We are not just acquiring brands—we’re building a digital house of brands powered by tech, data, and deep consumer insight.”

Another standout pillar of Mensa’s growth strategy was its global ambition from day one. Many of the acquired brands were quickly launched on international platforms like Amazon US, UAE, and UK, unlocking new revenue streams with minimal overhead. This cross-border playbook allowed Mensa to tap into the massive appetite for Indian-origin products, especially in fashion, skincare, and wellness.

Additionally, Mensa introduced centralised performance marketing and supply chain operations, dramatically improving delivery speed, margins, and customer satisfaction. Through its shared infrastructure, each brand retained its identity but gained access to Mensa’s scale advantages.

This model led to explosive results: more than 20 brands onboarded in under two years, with several seeing 3–4x growth within months of acquisition. According to company disclosures, Mensa crossed ₹1,500 crore in annualised revenue within its first 24 months—a rare feat in India’s startup ecosystem.

“Speed with quality is our mantra,” Narayanan said. “We don’t aim to build brands slowly—we aim to blitzscale them.”

By blending startup agility with enterprise-grade infrastructure, Mensa Brands carved out a powerful niche—a brand accelerator with scale, sophistication, and speed.

Marketing Strategy

Unlike traditional D2C rollups or new-age startups that pour resources into splashy campaigns, Mensa Brands embraced a disciplined, ROI-driven marketing approach focused on brand authenticity, performance optimisation, and cross-platform consistency.

Rather than overhauling the identity of the brands it acquired, Mensa adopted a brand-first philosophy—preserving each label’s unique voice while injecting strategic marketing muscle behind the scenes. The goal wasn’t to reinvent, but to amplify.

The company deployed its centralised performance marketing engine to fine-tune everything from creative testing to ad spend allocation, driving down customer acquisition costs and improving conversion rates across digital platforms. For instance, Mensa’s fashion and personal care brands saw 2x to 3x improvements in ROAS (Return on Ad Spend) within a few quarters of acquisition.

As Ananth Narayanan put it: “We don’t do marketing for marketing’s sake. Every rupee must move the needle—either on reach, retention, or revenue.”

Mensa also leveraged storytelling and micro-influencers to build emotional resonance with niche audiences, especially in beauty, wellness, and home décor segments. These campaigns emphasized founder stories, product origins, and user journeys, helping consumers connect with the brands on a more personal level.

Moreover, Mensa focused heavily on retail optimisation across marketplaces like Amazon, Myntra, Flipkart, and Nykaa. From SEO-rich product listings and improved imagery to real-time pricing tweaks and A+ content, the goal was to win on digital shelves through data-driven merchandising.

Crucially, Mensa minimised reliance on mass-market ATL (Above the Line) spends, preferring bottom-funnel performance channels such as Instagram, Google Shopping, YouTube Shorts, and influencer-led commerce. This not only kept acquisition costs in check but also aligned with the discovery behaviours of Gen Z and millennial shoppers.

By aligning brand integrity with marketing precision, Mensa created a growth engine that scaled impact without sacrificing identity—a rare feat in the crowded world of e-commerce.

“In a noisy digital world,” Narayanan noted, “what wins is not who shouts the loudest—but who speaks the most meaningfully.”

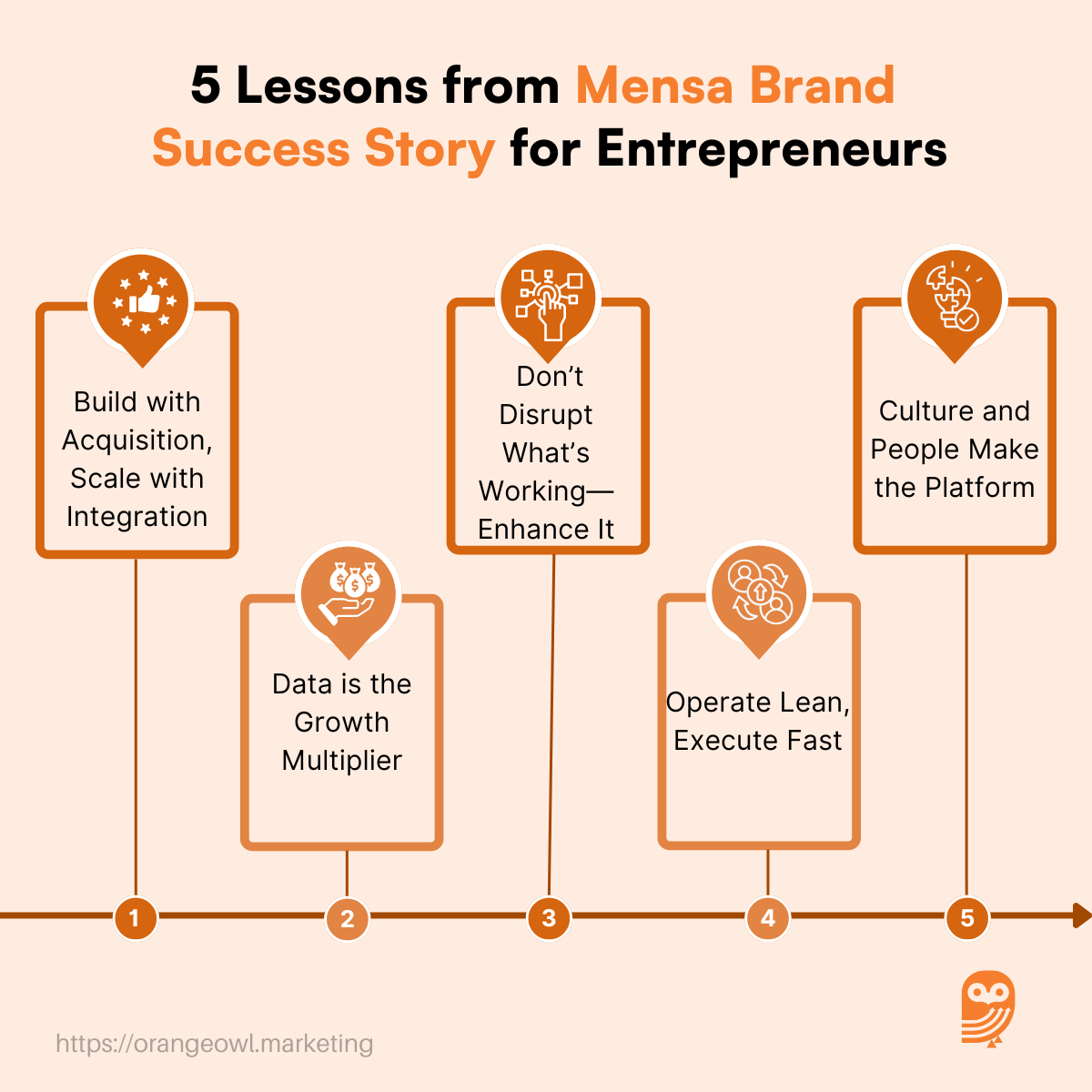

5 Innovative Lessons for Every Entrepreneur

1. Build with Acquisition, Scale with Integration

Mensa Brands showed that you don’t have to start from scratch to build a digital powerhouse. By acquiring profitable, high-potential D2C brands and turbocharging them with centralised tech, marketing, and supply chain support, Mensa scaled fast without reinventing the wheel.

The real magic was in the post-acquisition playbook: seamlessly integrating operations while retaining each brand’s unique identity.

We’re not a house of brands—we’re a platform of brands,” Ananth Narayanan often emphasises.

2. Data is the Growth Multiplier

Mensa didn’t just rely on instinct or aesthetics—it let the numbers guide everything. From inventory planning to pricing, campaign performance to customer cohorts, data was central to every decision. This allowed Mensa to optimise faster, reduce inefficiencies, and make each rupee spent more productive.

For any entrepreneur, the lesson is clear: in fast-moving consumer businesses, data isn’t an asset—it’s an advantage.

3. Don’t Disrupt What’s Working—Enhance It

Unlike roll-up models that rebrand and restructure aggressively, Mensa respected the DNA of the brands it acquired. It focused on accelerating what was already working—be it a loyal niche audience, a strong hero SKU, or organic social engagement.

This non-intrusive approach built trust with brand founders and ensured continuity with customers. Sometimes, scale comes not from disruption, but from thoughtful enhancement.

4. Operate Lean, Execute Fast

Speed was Mensa’s superpower. Thanks to its standardised tech stack, in-house performance marketing team, and shared backend infrastructure, brands under the Mensa umbrella could launch new campaigns, enter marketplaces, or expand into new categories in weeks, not months.

For founders, Mensa’s pace proved that agility isn’t just for early-stage startups—it can and should scale with the business.

5. Culture and People Make the Platform

While Mensa’s model is tech-heavy, its success is deeply human. Ananth Narayanan emphasised hiring execution-focused, high-agency individuals who thrived in a fast-moving, ownership-driven culture. This lean team built systems that scaled across 20+ brands with remarkable consistency.

The big takeaway? In a platform play, people aren’t just resources—they are the platform.

Conclusion

Acko’s journey from an ambitious insurtech startup to one of India’s leading digital insurers is a shining example of how technology, consumer empathy, and bold thinking can reimagine legacy industries. At a time when the insurance sector was mired in complexity and mistrust, Acko introduced transparency, speed, and relevance—redefining what customers expect from an insurer. More than just a disruptor, Acko became a category creator, inspiring a wave of digital transformation across the insurance landscape.

For entrepreneurs, Acko’s story offers more than just admiration—it offers a playbook. From building customer-first products to forming high-leverage partnerships, from staying ahead of regulation to innovating with agility, every move made by Acko holds a lesson. In the words of founder Varun Dua, “We didn’t want to sell fear. We wanted to sell trust and convenience.” That mindset, coupled with flawless execution, is what truly sets Acko apart.