Churn Rate Calculator

Table of Contents

What is Churn Rate?

The churn rate measures the percentage of customers who stop using a product or service during a given time frame. Understanding churn is critical for SaaS and subscription businesses aiming to improve retention.

Churn tells you how well you’re retaining customers. A high churn rate can quickly undo all your acquisition efforts, while a low churn rate signals strong customer loyalty and product-market fit.

Example:

If you had 1,000 customers at the start of the month and 950 at the end, your churn rate is 5%. That means 5% of your customer base stopped using your service that month.

How to Calculate Churn Rate

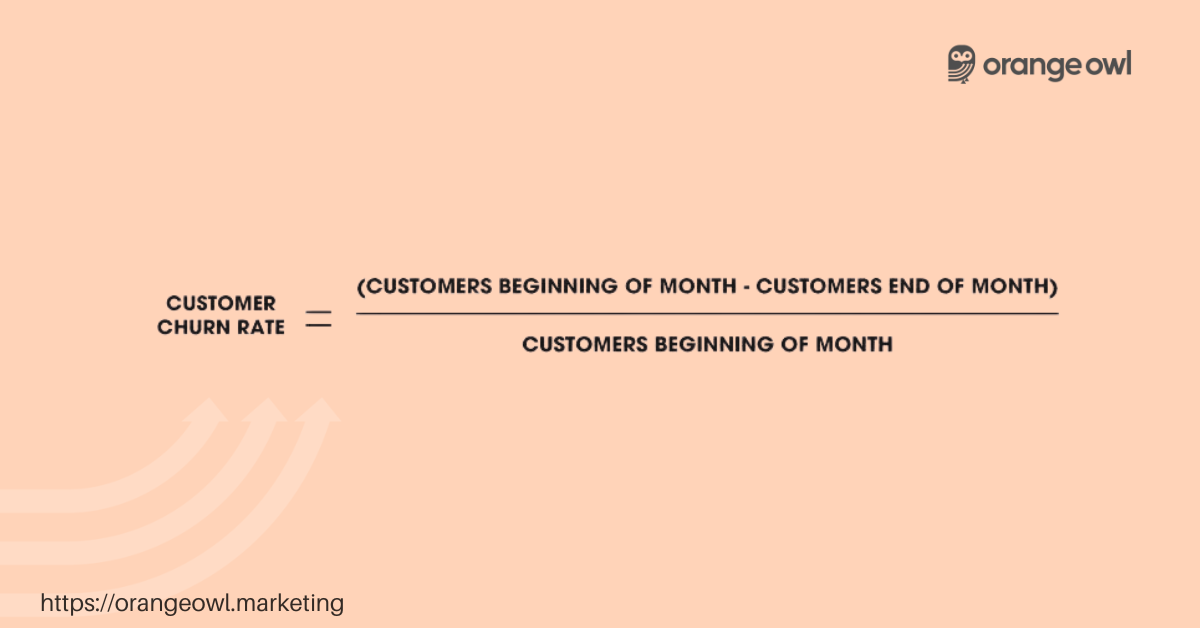

The churn rate formula is simple:

Churn Rate Formula:

Churn Rate (%) = (Customers Lost ÷ Total Customers at Start of Period) × 100

Example:

- Customers at Start: 1,000

- Customers Lost: 50

Churn Rate = (50 ÷ 1,000) × 100 = 5%

That means 5% of your customer base churned during the given time frame.

What’s a Good Churn Rate?

There’s no one-size-fits-all, but benchmarks help:

- SaaS & B2B: Monthly churn under 5% is good, under 2% is excellent

- B2C Subscriptions (e.g., streaming): Under 10% monthly is generally healthy

- Mobile apps or freemium tools: Churn is often higher (20–30%), but acceptable if offset by growth

A “good” churn rate depends on your business model, pricing, and how long your customers typically stick around (aka LTV).

Why Churn Rate Matters

Churn has a direct impact on your growth and revenue. Even with high acquisition, poor retention kills long-term scalability.

Knowing your churn rate helps you:

✅ Identify retention issues

✅ Improve onboarding and customer support

✅ Forecast revenue more accurately

✅ Understand customer satisfaction

✅ Prioritise product improvements

If you ignore churn, you’re constantly running uphill—replacing lost users instead of compounding growth.

Metrics That Impact Churn Rate

Several factors influence churn:

- Onboarding Experience: Weak onboarding leads to early drop-offs

- Customer Support: Slow or poor service increases frustration

- Product Value: If users don’t see consistent value, they’ll cancel

- Pricing Mismatch: Too expensive for the value = higher churn

- User Engagement: Infrequent or shallow usage signals low retention

Understanding these drivers helps you reduce churn over time.

What Can Increase Your Churn Rate?

If your churn rate is rising, it might be due to:

- Poor product-market fit

- Confusing user experience

- Billing issues or unexpected charges

- Limited product updates or value growth

- High competition offering better alternatives

- Negative customer reviews or sentiment

When this happens, it’s crucial to analyse customer feedback, behaviour, and cancellation reasons.

How Marketers and Founders Use Churn Rate

Churn rate isn’t just a retention metric—it’s a growth indicator. Businesses use it to:

- Measure customer loyalty

- Set LTV (Lifetime Value) expectations

- Refine pricing models

- Plan product roadmap priorities

- Monitor the impact of new features or campaigns

- Improve investor reporting and projections

Low churn boosts LTV, increases margins, and makes every dollar spent on acquisition go further.

Using a Churn Rate Calculator

With a Churn Rate Calculator, you can skip the spreadsheet.

Just enter:

- Total customers at the start of the period

- Number of customers lost in the period

And instantly see your churn rate in percentage.

Use it monthly, quarterly, or across cohorts to spot retention trends and take action before they snowball.

How to Reduce Your Churn Rate

Churn is inevitable, but it can be reduced with the right strategies:

- Improve onboarding to drive early engagement

- Send proactive customer support and check-ins

- Personalise product recommendations

- Offer loyalty rewards or discounts

- Analyse exit surveys to fix churn causes

- Communicate product updates and wins regularly

Remember: retaining existing customers is far cheaper than acquiring new ones.

When Should You Use Churn Rate?

Churn rate is especially critical if your business model relies on:

📦 Subscription revenue

💻 SaaS or product-led growth

📊 Long-term customer relationships

📱 Apps with recurring usage

💰 Forecasting LTV and CAC balance

If your business needs recurring revenue to survive, churn rate is your north star.

How Orange Owl Helps You Lower Churn

At Orange Owl, we help product-driven brands and SaaS companies reduce churn and improve retention. From onboarding flows and customer success strategy to engagement loops and feedback systems, we build journeys that keep users coming back.

Because keeping your customers shouldn’t be harder than getting them.

Frequently Asked Questions (FAQs) on Churn Rate

Voluntary churn occurs when customers choose to leave, while involuntary churn happens due to failed payments or card expiration.

Yes. A high churn rate means you need to acquire more customers more often, increasing your CAC over time.

Poor product-market fit often leads to higher churn. If your product doesn’t solve a real pain point, users won’t stick around.

Temporarily, yes — but it’s not a sustainable strategy. Discounts can mask deeper product or experience issues causing churn.

Monitor trends over time and pair churn rate with customer feedback, NPS, and usage metrics for a fuller picture.

Yes. Negative churn occurs when upsells, cross-sells, and expansions from existing customers outweigh the revenue lost from churned ones.