SaaS Gross Margin Calculator

Table of Contents

Understand Your Profitability Beyond Revenue

Revenue growth is exciting, but in SaaS, it doesn’t tell the full story. What really matters is how much of that revenue you actually keep after covering the costs of delivering your service. That’s where SaaS Gross Margin comes in.

Our SaaS Gross Margin Calculator helps you quickly measure how profitable your recurring revenue is after accounting for direct costs like hosting, customer support, and third-party tools.

Whether you’re an early-stage SaaS founder proving unit economics or a scaling business preparing for fundraising, tracking Gross Margin gives you clarity on financial health and long-term sustainability.

What is SaaS Gross Margin?

SaaS Gross Margin is the percentage of your revenue left after subtracting the Cost of Goods Sold (COGS) — the direct expenses required to deliver your product.

Think of it as your profitability lens: while MRR shows revenue growth, Gross Margin reveals how efficiently you’re turning that revenue into profit.

High gross margins (70–90%) are a hallmark of successful SaaS companies because software scales without significantly increasing costs.

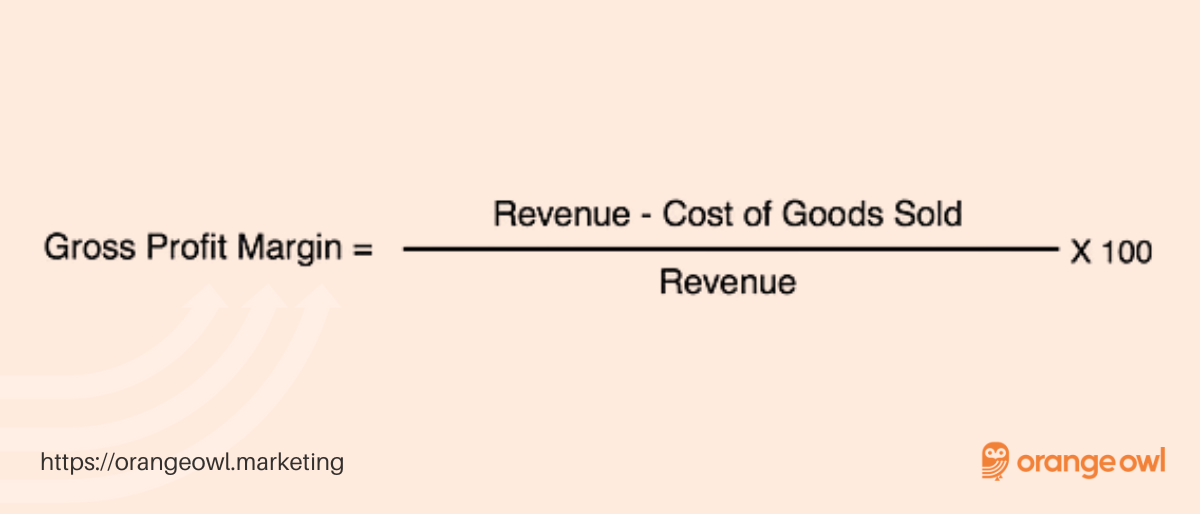

SaaS Gross Margin Formula

Gross Margin (%) = ((Revenue − COGS) / Revenue) × 100

Example:

Example:

- Monthly Revenue = ₹10,00,000

- COGS (servers, support, tools) = ₹2,00,000

Gross Margin=10,00,000−2,00,00010,00,000×100=80%Gross\ Margin = \frac{10,00,000 – 2,00,000}{10,00,000} \times 100 = 80\%Gross Margin=10,00,00010,00,000−2,00,000×100=80%

👉 This means 80% of your revenue remains after covering delivery costs.

Why Gross Margin Matters in SaaS

Tracking gross margin is crucial because it:

- Shows true profitability – Revenue growth means little if margins are weak.

- Validates scalability – Strong margins signal efficient growth.

- Attracts investors – VCs and acquirers look for SaaS with high, sustainable margins.

- Guides pricing strategy – Helps balance customer value with delivery costs.

- Highlights inefficiencies – Rising costs can erode margins even as revenue grows.

Who Should Use This Calculator?

- SaaS founders & CFOs validating unit economics.

- Growth-stage startups preparing for funding or scaling.

- Finance teams are measuring operational efficiency.

- Investors & VCs assessing SaaS business health.

SaaS Gross Margin vs Other Metrics

Metric | Measures | Best For |

Gross Margin | Revenue after delivery costs | Profitability |

MRR Growth | Month-over-month recurring revenue | Growth speed |

CAC | Cost to acquire a customer | Efficiency |

LTV | Customer lifetime revenue | Retention & value |

How to Use Gross Margin in Your Growth Strategy

Gross margin isn’t just an accounting metric — it’s a strategic lever. Here’s how to use it:

- Benchmark against SaaS norms (70–90% is strong).

- Identify cost creep (support, hosting, third-party tools).

- Refine pricing to ensure profitability scales with growth.

- Align with CAC & LTV for a complete view of unit economics.

✅ Tips to Improve SaaS Gross Margin

- Optimise cloud & infrastructure costs.

- Automate support to reduce overhead.

- Negotiate better deals with third-party vendors.

- Shift customers to self-service models.

- Revisit pricing to reflect value delivered.

🎯 Real-Life Example

A SaaS company earns ₹50,00,000 in monthly recurring revenue.

- COGS = ₹12,50,000 (25% of revenue).

- Gross Margin = 75%.

👉 This margin is healthy but slightly below top-tier SaaS benchmarks. By optimizing hosting costs and automating support, the company could lift margins closer to 80–85%, making it more attractive to investors.

💡 When Gross Margin Might Be Misleading

- Short-term spikes – A one-time cost reduction may inflate margins.

- Hidden overheads – Misclassifying costs (e.g., putting support in OPEX instead of COGS) can distort results.

- Early-stage volatility – Small revenue bases can exaggerate margin swings.

How Orange Owl Helps You

At Orange Owl, we help SaaS founders and growth teams go beyond just tracking revenue to understanding true profitability. From analyzing cost structures to refining pricing and optimizing delivery efficiency, we ensure your gross margins stay healthy as you scale.

Because it’s not just about growing fast — it’s about growing profitably.

Frequently Asked Questions (FAQs) on SaaS Gross Margin

SaaS companies have much higher gross margins since there are no physical goods; costs are mainly cloud hosting and support.

Yes, customer support salaries and tools are usually included in COGS, as they directly impact service delivery.

High cloud or infrastructure costs reduce gross margin. Optimizing hosting contracts and usage can improve margins.

Smart pricing (like tiered or value-based) can raise revenue without adding significant extra costs, improving margins.

Yes, if they have strong growth, retention, and a clear path to margin improvement over time.