CMGR Calculator

Table of Contents

What is MRR (Monthly Recurring Revenue)?

Customer Growth Rate (CMGR) is one of the most vital metrics for any business that wants to measure how fast its customer base is expanding over a specific period of time. Tracking growth rate helps companies evaluate long-term sustainability rather than relying on short-term spikes. Unlike one-time growth surges, CMGR provides a sustainable, month-over-month view of growth, helping businesses understand whether their customer acquisition strategies are working consistently.

In today’s competitive landscape, customer growth is not just about attracting new users—it’s also about retaining them and ensuring that the value delivered matches their expectations. CMGR bridges this gap by giving companies a clear picture of long-term momentum rather than short-lived wins.

For startups, CMGR reflects early traction and validates whether the business model is scalable. For established companies, it highlights areas where customer engagement, retention, or marketing strategies need improvement. By tracking CMGR, businesses can identify growth bottlenecks, refine their acquisition channels, and make informed strategic decisions.

In essence, CMGR is more than just a number—it’s a compass that guides businesses toward sustainable growth by combining the power of acquisition, retention, and engagement into a single, actionable metric.

How to Calculate CMGR

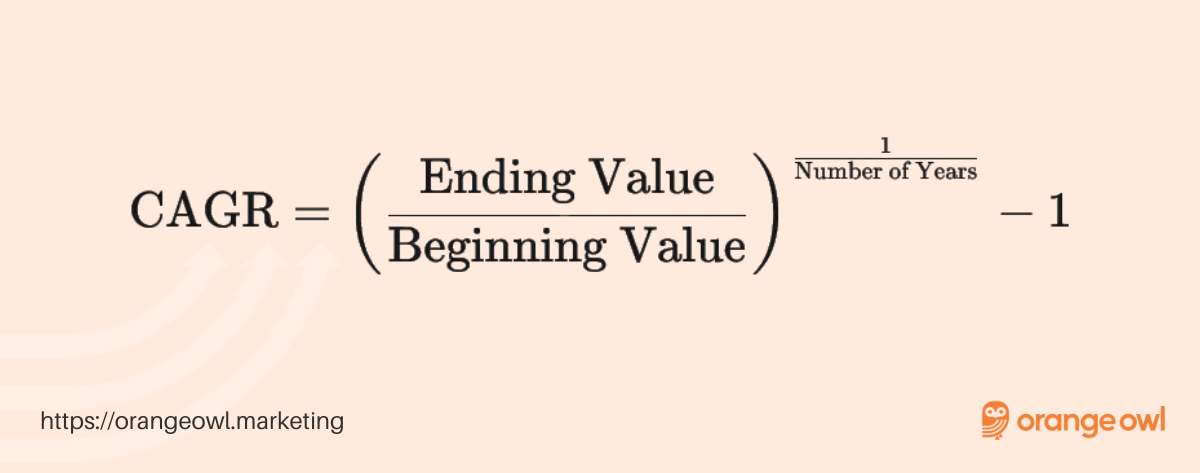

The formula for CMGR looks a bit math-heavy at first, but it’s easy once you break it down:

CMGR Formula:

CMGR = (Ending Value / Beginning Value)^(1/N) – 1

Where:

- Ending Value = Metric at the end of the period (e.g., revenue, users, MRR)

- Beginning Value = Metric at the start of the period

- N = Number of months

Example:

- Beginning MRR: ₹1,00,000

- Ending MRR (after 12 months): ₹5,00,000

- N = 12

CMGR = (5,00,000 / 1,00,000)^(1/12) – 1 = 14.7%

This means your monthly compounded growth rate is ~14.7%.

What’s a Good CMGR?

Just like ROAS, there’s no one-size-fits-all. It depends on your stage, industry, and model. But here are some benchmarks:

- Early-stage startups (pre-PMF): 15–25% CMGR is often targeted to show traction

- Growth-stage SaaS: 10–15% CMGR can signal strong momentum

- Mature businesses: 3–8% CMGR is considered sustainable

Paul Graham, Y Combinator’s co-founder, once said: “A 5–7% weekly growth rate translates into an extraordinary monthly compounding growth.” That’s why investors love CMGR—it shows if your business can scale predictably.

Why CMGR Matters

CMGR is one of the clearest indicators of compounding growth. While revenue spikes look impressive, CMGR shows whether your business is growing in a healthy, sustained way.

Tracking CMGR helps you:

✅ Understand long-term growth trends

✅ Compare different growth periods accurately

✅ Show predictable traction to investors

✅ Forecast future revenue or user base

Without CMGR, you might mistake short-term boosts for long-term success.

Metrics That Affect CMGR

CMGR doesn’t stand alone. It’s influenced by several growth levers:

- Customer Acquisition: More effective marketing = faster compounding growth

- Retention/Churn: The lower the churn, the higher the compounding effect

- ARPU / MRR Expansion: Upsells and cross-sells improve your growth baseline

- Virality & Referrals: Organic loops amplify compounding without equal spend

What Can Bring Your CMGR Down?

Growth rarely stays linear. A few common reasons why CMGR may stall:

❌ High churn rate is eating away at new customer gains

❌ Over-reliance on one channel that saturates

❌ Inefficient acquisition spend is slowing new growth

❌ Product-market misalignment is limiting adoption

CMGR is unforgiving—if churn outpaces acquisition, compounding reverses.

How Founders and Teams Use CMGR

For startups, CMGR isn’t just a vanity metric—it’s a storytelling tool. Here’s how it’s used:

- Founders: Showcase traction and growth consistency in investor decks

- Investors: Evaluate scalability and predict future returns

- Marketing/Growth Teams: Benchmark performance and optimise acquisition + retention

- Finance Teams: Forecast future revenue with more accuracy

Using a CMGR Calculator

Instead of doing math manually, a CMGR calculator simplifies the process:

Just plug in:

- Beginning Value (e.g., users, MRR, revenue)

- Ending Value

- Number of months

…and instantly get your compounding growth rate. It’s quick, reliable, and perfect for reports or pitches.

How to Improve Your CMGR

Boosting CMGR isn’t about short-term hacks—it’s about building sustainable, compounding growth loops.

Here are some proven strategies:

- Reduce churn: Retaining customers is the fastest way to compound

- Add upsells & cross-sells: Expand revenue from existing customers

- Experiment with new channels: Diversify acquisition sources

- Double down on virality: Referral loops multiply, compounding

- Optimise onboarding: Faster activation = higher long-term retention

When Should You Use CMGR?

CMGR is most valuable when:

📈 Presenting growth in investor decks

📊 Comparing early traction across months

🔮 Forecasting long-term outcomes

🏆 Evaluating if growth is sustainable vs. spiky

It’s especially crucial for SaaS, D2C, and subscription-based businesses.

How Orange Owl Helps You Improve CMGR

At Orange Owl, we partner with B2B startups and growing brands to accelerate their Customer Growth Rate (CMGR) through data-driven acquisition strategies, retention-focused campaigns, and seamless onboarding journeys. We don’t just help you attract new customers—we help you keep them engaged and loyal. Our approach ensures your customer base grows consistently month after month, aligning with your long-term vision of sustainable business growth.

Our approach ensures your CMGR isn’t just a number—it’s a reflection of a business designed to scale month after month.

Frequently Asked Questions (FAQs) on CMGR

There’s no universal benchmark, but many VCs look for 10–20% CMGR in the early stages to validate traction and scalability.

Investors use CMGR to gauge whether a company has consistent, compounding growth potential instead of short-lived spikes.

Yes. A high CMGR from a very small base (e.g., 100 → 500 users) may look impressive but might not indicate sustainable growth.

Consistently high CMGR demonstrates traction, making it easier for startups to attract venture capital and negotiate better valuations.

Indirectly, yes. If CMGR slows down or turns negative, it may signal rising churn or weaker customer retention.