Rule of 40 Calculator

Table of Contents

What is the Rule of 40 Calculator?

The Rule of 40 is a financial benchmark used to measure the balance between growth and profitability in SaaS and subscription-based businesses. It acts as a litmus test for operational efficiency and long-term sustainability.

The principle is simple: Revenue Growth Rate (%) + Profit Margin (%) ≥ 40

- If the sum is above 40, the company is considered financially healthy and efficiently scaling.

- If it’s below 40, the company may be burning too much cash or growing inefficiently.

Example:

A company growing revenue at 35% with a 10% profit margin scores 45 (35 + 10), which is healthy. Conversely, a company growing at 20% with –5% margins scores 15, signaling challenges.

How to Calculate the Rule of 40

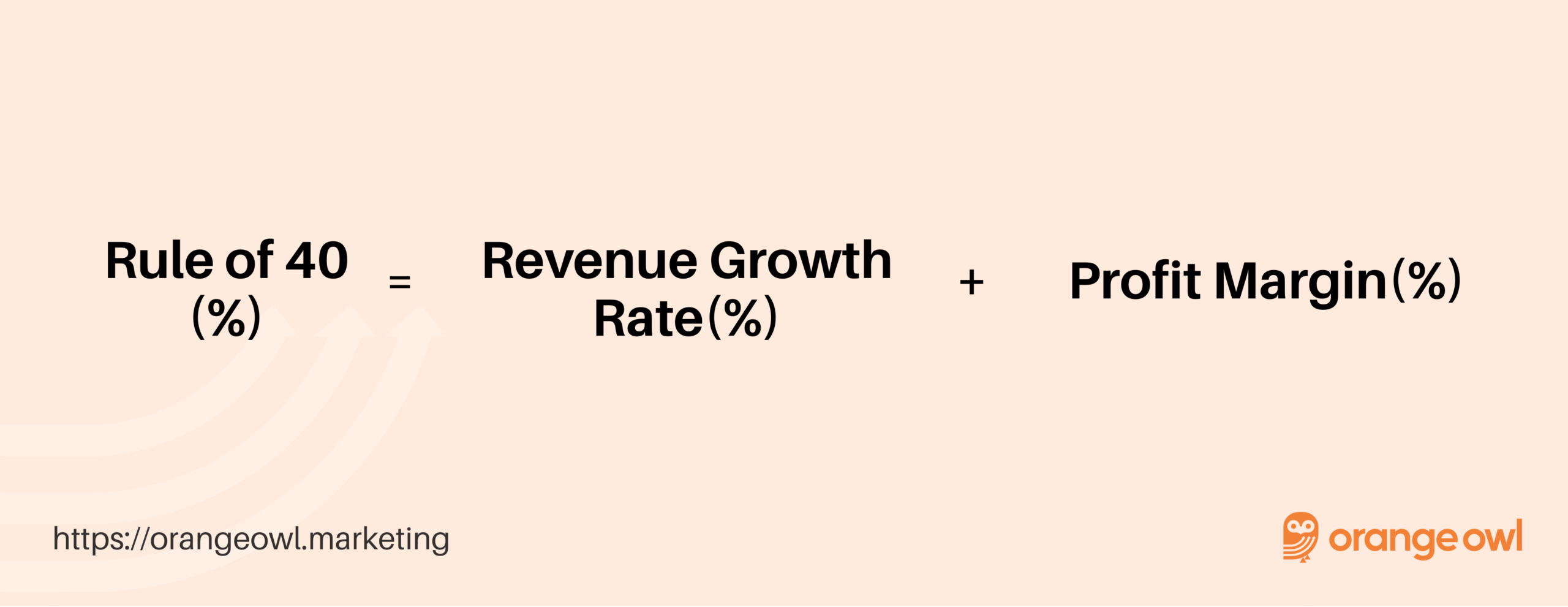

The Rule of 40 formula is straightforward:

Rule of 40 = Revenue Growth Rate (%) + Profit Margin (%)

- Revenue Growth Rate (%) = (Current Period Revenue – Prior Period Revenue ÷ Prior Period Revenue) × 100

- Profit Margin (%) = (Net Profit ÷ Total Revenue) × 100

Example:

- Revenue Growth Rate: 30%

- Profit Margin: 12%

Rule of 40 = 42% → Strong performance

This means your company is operating above the Rule of 40 threshold, indicating strong performance.

What’s a Good Rule of 40 Score?

A score of 40% or higher is generally considered healthy, but the interpretation varies by stage:

- Early-stage SaaS: High growth, often with negative margins (e.g., 60% growth, –10% margin → Rule of 40 = 50, still strong).

- Mid-stage companies: Balance between growth and improving profitability (e.g., 25% growth, 20% margin → 45).

- Mature companies: Lower growth but strong profitability (e.g., 10% growth, 35% margin → 45).

Why the Rule of 40 Matters

The Rule of 40 helps investors, founders, and operators understand if growth is being achieved efficiently. It shows whether the company is burning too much cash or scaling sustainably.

Knowing your rule of 40 score helps you:

✅ Benchmark your performance against SaaS standards

✅ Decide whether to focus on growth or profitability

✅ Assess if your business model is scalable

✅ Gain investor confidence

Metrics That Affect the Rule of 40

Several financial drivers impact the Rule of 40 score:

- Revenue Growth Rate: Faster top-line growth boosts the metric

- Profit Margin: Higher margins improve sustainability

- Operating Expenses: Keeping costs under control protects profitability

- Customer Acquisition Cost (CAC): Efficient acquisition supports margins

- Churn Rate: Lower churn strengthens both growth and profitability

What Can Bring Your Rule of 40 Down?

Falling below 40 usually means one of these:

- High operating costs eating into margins

- Aggressive spending on customer acquisition

- Slower-than-expected revenue growth

- Inefficient pricing or low retention rates

- Excessive hiring or inefficient operationsHow Marketers and Founders Use Churn Rate

How Investors and Companies Use the Rule of 40

The Rule of 40 isn’t just a health check—it’s a decision-making tool:

- Investors: Use it to assess whether SaaS companies are scaling sustainably

- Founders/CEOs: Decide whether to prioritize profitability or growth

- Finance Teams: Plan budgets and future strategies

- Boards: Benchmark portfolio companies

Using a Rule of 40 Calculator

A calculator gives instant insights:

- Input annual growth rate

- Input profit margin

- Output = Rule of 40 score

This is especially useful for scenario planning:

- “What if we cut marketing spend by 10%?”

- “What if we grow 25% but margins drop?”

Boards often use calculators during budget discussions to test trade-offs.

How to Improve Your Rule of 40

Improving your score means boosting growth, margins, or both:

Improve Growth

- Focus on high-value segments

- Reduce churn via better onboarding & support

- Expand into new markets or verticals

- Introduce premium or add-on products

Improve Profitability

- Revisit pricing strategy (value-based, tiered, usage)

- Improve gross margin (optimize hosting, renegotiate vendor contracts)

- Cut underperforming marketing channels

- Automate repetitive processes

Balance Both

- Track unit economics (LTV/CAC > 3)

- Keep burn multiple < 1.5x

- Phase growth spending to align with revenue

When Should You Use the Rule of 40?

The Rule of 40 is especially useful for:

- SaaS and subscription-based businesses

- Companies balancing growth with investor expectations

- Fundraising discussions to prove sustainable scaling

- Long-term strategy and financial planning

How Orange Owl Helps You

At Orange Owl, we help SaaS and subscription businesses strike the right balance between rapid growth and profitability. From refining pricing models and reducing churn to improving unit economics and optimizing go-to-market strategies, we ensure your Rule of 40 score doesn’t just meet the benchmark—it consistently climbs higher.

Because it’s not just about growing fast, it’s about scaling sustainably and building long-term investor confidence.

Frequently Asked Questions (FAQs) on Rule of 40

Because it’s a quick way to compare SaaS companies, regardless of whether they prioritize growth or profitability.

Yes. Some hypergrowth SaaS companies (e.g., Zoom during 2020) had 80–100% growth with positive margins, crossing 100.

Rarely. It’s mainly for subscription or recurring revenue models, though some fintech and media firms also use it.

No. It’s one benchmark. Companies also need strong unit economics, retention, cash flow, and competitive moat.

Quarterly is standard, but fast-scaling SaaS firms may track it monthly.

Not too much. At early stages, growth matters more. But as you mature, investors will expect progress toward 40.

SaaS companies with higher Rule of 40 scores typically enjoy higher EV/Revenue multiples, meaning they’re more valuable per dollar of revenue.

Yes. For example, temporarily cutting R&D or S&M spend may improve margins but hurt long-term growth. Investors usually dig deeper beyond the headline score.