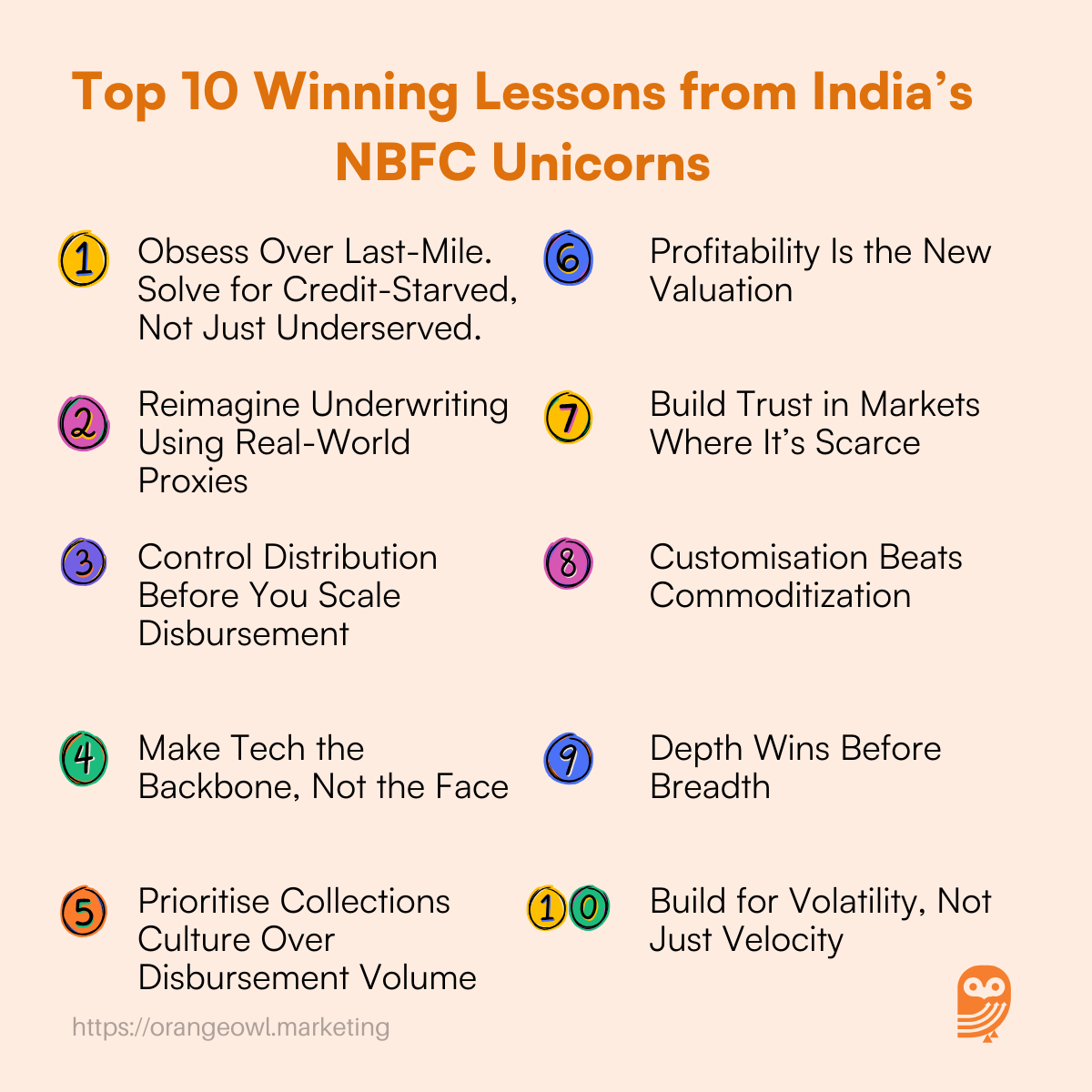

Top 10 Winning Lessons from India’s NBFC Unicorns

Vivek Goel

June 17, 2025

Table of Contents

Introduction

While Tech-savvy Non-Banking Financial Companies (NBFCs) are rewriting the rules of lending. These startups are not just plugging the credit gap; they’re doing it with deep customer empathy, powerful data engines, and relentless execution.

Leading the charge are unicorns like InCred Finance, Five Star Business Finance, and OfBusiness. Each of these companies has cracked the code to serve India’s underserved segments, ranging from small businesses and salaried professionals to first-time borrowers in Tier 2 and 3 cities.

We recently chronicled their incredible journeys in detail:

💡 InCred Finance Success Story: 5 Insightful Lessons for Every Entrepreneur

🏢 Five Star Business Finance: 5 Powerful Lessons for Every Entrepreneur

🚀 OfBusiness Success Story: 5 Valuable Lessons for Every Entrepreneur

Now, we bring you 10 game-changing lessons from these resilient lenders—principles that apply not only to fintech but to every entrepreneur navigating India’s complex, high-potential markets.

1. Obsess Over Last-Mile. Solve for Credit-Starved, Not Just Underserved.

OfBusiness didn’t just provide loans—it embedded itself into the supply chains of SMEs by offering materials, logistics, and working capital.

Five Star focused on micro-entrepreneurs in Tier 2/3 towns with stable cash flows but no documentation.

InCred served salaried professionals and businesses neglected by traditional banks.

✅ Lesson: Build around the borrower’s ecosystem, not just the borrower. This lets you:

- Create product-market fit beyond credit

- Drive retention through supply chain integration

- Serve niche markets others ignore

- Deepen stickiness with bundled value

2. Reimagine Underwriting Using Real-World Proxies

While banks relied on income proofs, these NBFCs looked elsewhere.

OfBusiness used transaction data and purchase orders.

Five Star sent local agents to assess cash flow directly.

InCred blended credit scores with GST data and bank statements.

✅ Lesson: When financial paperwork is absent, use operational signals. This helps you:

- Assess creditworthiness accurately in informal markets

- Expand lending to new-to-credit users

- Lower default risk with better context

- Build your data moat

3. Control Distribution Before You Scale Disbursement

Five Star scaled by first dominating local markets in South India.

OfBusiness built direct sales teams in key industrial regions.

InCred combined online onboarding with offline verification where needed.

✅ Lesson: Distribution is infrastructure, not just access. Focus here to:

- Control customer acquisition costs

- Build high-quality, localised loan books

- Improve collections with community presence

- Enable repeat usage via physical trust

4. Make Tech the Backbone, Not the Face

These NBFCs didn’t sell themselves as tech-first, but used tech for efficiency.

OfBusiness built OS1 to automate procurement and lending.

InCred deployed AI for fraud checks and pricing.

Five Star kept tech quiet, using it to streamline collections.

✅ Lesson: Let tech scale operations behind the scenes. This allows you to:

- Build silently scalable systems

- Keep the human touch where needed

- Reduce operational friction

- Improve risk controls invisibly

5. Prioritise Collections Culture Over Disbursement Volume

Five Star invested deeply in borrower relationships and repayment behaviour.

OfBusiness aligned loan cycles with the customer’s business cycles.

InCred used analytics to flag and manage repayment risks early.

✅ Lesson: Lending starts with disbursement, but ends with discipline. Focus on:

- Collections culture as your foundation

- Data-led early warning systems

- Reducing NPAs sustainably

- Building repayment behaviour from day one

6. Profitability Is the New Valuation

Even as others burned cash for growth, these firms stayed lean.

Five Star achieved early profitability with high EBITDA margins.

OfBusiness scaled its commerce-finance model profitably.

InCred restructured for focused, profitable verticals.

✅ Lesson: Profit discipline builds staying power. Use it to:

- Attract long-term capital

- Avoid dependency on external funding

- Strengthen your balance sheet

- Design for resilience, not just scale

7. Build Trust in Markets Where It’s Scarce

Five Star’s loan officers act more like local mentors.

OfBusiness earns trust by enabling trade, not just credit.

InCred invests in borrower education and transparent processes.

✅ Lesson: In low-trust markets, trust is your biggest differentiator. Build it by:

- Localising teams and messaging

- Simplifying terms and communication

- Engaging with empathy, not just efficiency

- Making service the heart of your brand

8. Customisation Beats Commoditization

OfBusiness tailored repayment timelines to business cash flows.

Five Star adjusted EMI schedules to informal income patterns.

InCred built differentiated loan products for salaried, self-employed, and students.

✅ Lesson: Personalisation unlocks retention. It allows you to:

- Match products to customer realities

- Reduce delinquency through flexibility

- Drive repeat usage and loyalty

- Serve complex customer personas

9. Depth Wins Before Breadth

Five Star focused heavily on South India before expanding.

OfBusiness grew deep in B2B clusters before going national.

InCred scaled within verticals like education and SME finance before broader diversification.

✅ Lesson: Dominate micro-markets before national expansion. This lets you:

- Build defensible strongholds

- Increase efficiency with focus

- Develop playbooks for scale

- Avoid premature dilution of resources

10. Build for Volatility, Not Just Velocity

Every NBFC faced serious shocks—from IL&FS to COVID.

Five Star kept NPAs low with consistent underwriting.

OfBusiness diversified into SaaS and commerce for resilience.

InCred pivoted away from risky portfolios when needed.

✅ Lesson: Scale means nothing if you can’t survive shocks. Prepare by:

- Stress-testing operations regularly

- Diversifying income sources

- Adapting quickly to regulatory shifts

- Prioritising resilience in every decision

Conclusion: Lending Is Just the Beginning

The rise of OfBusiness, Five Star Business Finance, and InCred Finance proves that India’s most successful NBFCs aren’t just lenders—they’re ecosystem enablers. They’ve redefined how trust is earned, how underserved markets are served, and how sustainable scale is achieved.

These are not overnight stories. They are case studies in resilience, operational depth, and customer-centric innovation.

✅ Whether you’re building a fintech, healthtech, or B2B startup, the lessons from NBFC unicorns offer timeless wisdom:

– Design for Bharat

– Operate with discipline

– Innovate with empathy

– Scale with purpose

Because in India, the best ventures don’t just unlock capital—they unlock possibility. And the most enduring companies aren’t chasing trends—they’re building trust, one customer at a time.