Acko Success Story: 5 Innovative Lessons for Every Entrepreneur

Vivek Goel

August 20, 2025

Table of Contents

Introduction

In 2016, Varun Dua and Ruchi Deepak set out to disrupt one of India’s most opaque and underserved industries: insurance. The duo founded Acko, India’s first digital-native insurance company, with the vision of creating a seamless and technology-driven platform that would eliminate the complexity and confusion that had long plagued the sector. At the time, buying insurance often meant tedious paperwork, unclear terms, delayed claims, and middlemen-driven sales—experiences that discouraged millions of Indians from securing even basic coverage.

Dua, who had previously co-founded Coverfox (an insurance aggregator), understood these bottlenecks firsthand. With Acko, the goal was clear: cut out intermediaries, digitize the entire customer journey, and offer affordable, intuitive, and relevant insurance products that could be accessed with a few clicks. Instead of mimicking traditional insurers, Acko reimagined the model entirely—from product design and pricing to distribution and claims processing.

By leveraging deep data analytics, automation, and a customer-first mindset, Acko built products that were contextual and bite-sized—think in-trip insurance for an Ola ride, screen damage protection for a smartphone, or tailored health insurance plans for millennials. Over the years, this innovative model gained traction, helping Acko reach more than 28 million customers and issue over 80 million policies, all while maintaining a lean digital infrastructure.

In an industry where trust is paramount and innovation is rare, Acko proved that with the right vision, it’s possible to not only enter a regulated, legacy-heavy space—but to lead it.

Origin Story

The seeds of Acko were sown during Varun Dua’s entrepreneurial stint with Coverfox, an insurance aggregator platform that sought to simplify the insurance buying process. While Coverfox helped users compare and purchase policies, Dua soon realized that aggregators could only do so much. The real issues—such as rigid legacy systems, cumbersome documentation, limited product innovation, and opaque pricing—were deeply embedded in the traditional insurance ecosystem itself.

These insights became the catalyst for something far more ambitious. Along with co-founder Ruchi Deepak, Dua envisioned an entirely new approach to insurance—one that was digital-first, customer-centric, and radically simplified. They wanted to move beyond simply selling existing products better, and instead, build a new-age insurer from the ground up that offered contextual, bite-sized, and digitally native insurance experiences.

In 2017, Acko secured its license from the Insurance Regulatory and Development Authority of India (IRDAI), becoming the first Indian insurance company licensed to operate fully online. This regulatory green light allowed Acko to break free from the limitations of agent networks and branch-heavy models. Instead, the company could focus on automation, personalization, and affordability—hallmarks of modern digital businesses.

Acko’s early products reflected this disruptive thinking. Whether it was micro-insurance for cab rides, gadget insurance, or zero-paper car insurance policies, the startup quickly earned attention for its relevance, ease of use, and clarity. More than just selling policies, Acko set out to change consumer expectations around insurance.

As Varun Dua put it in an interview:

“We weren’t trying to fix a few things within the system — we wanted to rebuild the system entirely, but digitally.”

Business Landscape and Challenges

When Acko entered the insurance space in 2017, it was up against a deeply entrenched ecosystem dominated by traditional players like LIC, ICICI Lombard, and Bajaj Allianz. The Indian insurance industry—particularly in the non-life segments such as motor, health, and travel—was notoriously slow-moving, bound by legacy systems, manual processes, and a distribution-heavy model that relied on agents and paperwork.

More importantly, insurance penetration in India was still alarmingly low. As per IRDAI reports from that period, non-life insurance penetration stood at just around 1% of GDP, with consumer awareness and trust in insurance products lagging behind global benchmarks. Most consumers viewed insurance as a complicated, jargon-filled necessity—only to be dealt with during emergencies or when mandated by law, such as for vehicles.

Acko’s entry into this landscape posed three major challenges:

- Consumer Trust Deficit: As a new brand without a legacy or physical presence, convincing users to buy policies online—especially high-involvement ones like motor or health insurance—was a massive hurdle.

- Regulatory Compliance: Operating as a digital-only insurer required meticulous navigation of IRDAI regulations, from product filings and solvency margins to claim disclosures and data handling.

- Market Education and Behavior Change: Most Indian consumers were used to agent-led policy purchases. Acko had to not only educate them about its offerings but also change the purchasing behavior itself.

However, Acko turned these challenges into opportunities by going where the consumers already were—digital platforms. By forging strategic partnerships with Amazon, Ola, Zomato, redBus, and MakeMyTrip, Acko integrated insurance into everyday digital experiences. Whether it was insuring an Ola cab ride, a gadget purchased from Amazon, or a hotel booking on a travel app, Acko made insurance seamless, relevant, and almost invisible.

This embedded model helped build trust through association, offered contextual coverage at affordable micro-premiums, and introduced users to insurance in a non-intimidating way.

As Varun Dua remarked in an interview:

“If insurance has to reach a billion Indians, it has to be effortless, contextual, and invisible. That’s the future we’re building for.”

Through this approach, Acko didn’t just challenge incumbents—it redefined what insurance could feel like for India’s digital-first consumers.

Growth Strategies

Acko’s remarkable growth story is anchored in a series of well-executed strategic decisions that disrupted the traditional insurance model. First and foremost, Acko adopted a digital-only insurance model—a bold move that helped eliminate intermediaries, cut down on paperwork, and significantly reduce operational costs.

These savings were passed on to consumers in the form of lower premiums, making insurance more affordable and accessible. One of Acko’s most game-changing moves was its embedded insurance model, achieved through strategic partnerships with major digital platforms like Amazon, Ola, redBus, and Zomato.

These collaborations allowed Acko to offer bite-sized, contextual insurance products—such as trip protection for cab rides or mobile damage cover during device purchases—at the exact point of need, enhancing both conversion and utility. Acko also stood out in the industry by leveraging data-driven underwriting, using behavioral, transactional, and usage data to accurately assess risk and offer personalized coverage options.

This data-first approach enabled smarter pricing and quicker decision-making. Moreover, Acko maintained a customer-centric ethos by simplifying policy documents, enabling instant claim settlements, and offering quick, responsive support—fostering a sense of trust and loyalty in a traditionally skeptical market. Together, these strategies not only helped Acko differentiate itself from legacy insurers but also positioned it as a trailblazer in India’s emerging insurtech landscape.

Marketing Strategy

Unlike many startups that rely heavily on mass advertising, Acko adopted a more nuanced and consumer-education-led marketing strategy. At the heart of Acko’s marketing was a focus on transparency, simplicity, and real-world relevance.

The brand used content marketing, video explainers, blogs, and user testimonials to demystify insurance for everyday consumers, building trust through education rather than persuasion. Acko also leaned on its strategic B2B2C partnerships to embed the brand organically into digital touchpoints, reducing the need for hard-sell tactics.

Campaigns often highlighted real-life use cases—like how a 10-rupee insurance plan saved a customer from a huge medical bill—creating an emotional connection and reinforcing the brand’s value proposition. This focus on everyday impact helped Acko cultivate credibility and relatability, especially among digitally native consumers who prefer self-service and clarity. As a result, Acko grew not just in users but also in trust—arguably the most valuable currency in the insurance industry.

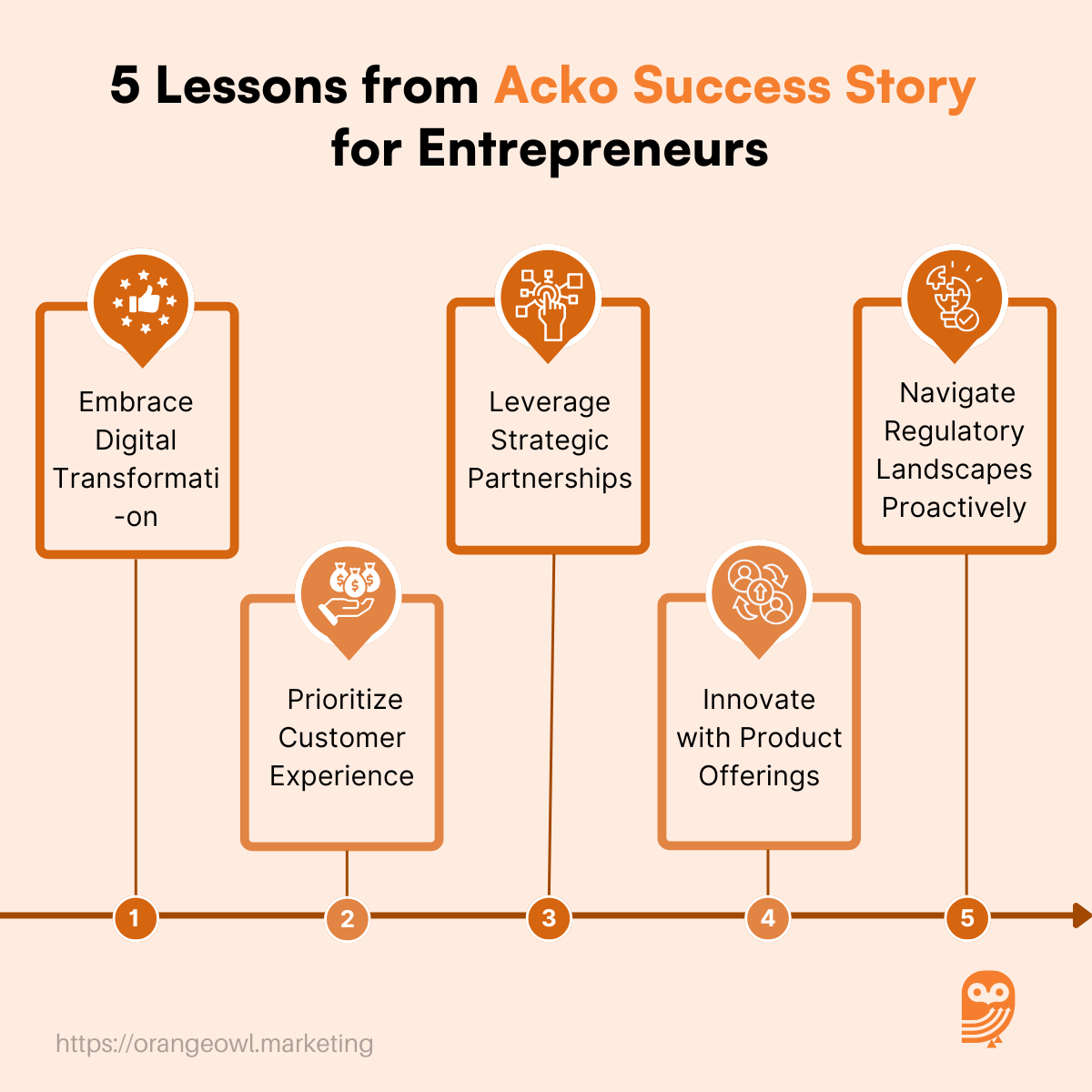

5 Innovative Lessons for Every Entrepreneur

1. Embrace Digital Transformation

Acko’s rise in the insurtech space highlights how digital innovation can redefine even the most traditional industries. From policy issuance to claim settlement, Acko digitized every aspect of the insurance journey, eliminating paperwork and physical intermediaries.

This not only made the process faster and more efficient but also drastically reduced operational costs. By building an entirely tech-led infrastructure from the ground up, Acko delivered a seamless experience that appealed to India’s fast-growing digital-first audience—proving that technology isn’t just a support tool, but a fundamental enabler of disruption.

2. Prioritize Customer Experience

At the heart of Acko’s strategy lies a deep commitment to making insurance simple, accessible, and transparent. Traditional insurance often alienated customers with complex jargon, slow processes, and opaque policies.

Acko flipped this narrative by offering clear communication, minimal documentation, and instant support, creating a frictionless experience that won over consumers. Entrepreneurs across sectors can learn from Acko’s example: the easier you make it for customers to engage with your product, the more they’ll trust and adopt it.

3. Leverage Strategic Partnerships

One of Acko’s smartest growth moves was forming contextual alliances with large consumer-facing platforms like Amazon, Ola, Zomato, and redBus. These partnerships allowed Acko to offer embedded insurance directly at the point of transaction—whether it was insuring a cab ride, a smartphone, or a movie ticket.

Such integrations not only gave Acko immediate access to millions of users but also reduced customer acquisition costs and ensured that insurance became a natural part of the digital buying journey. Strategic collaborations can offer exponential scale, especially when the product complements an existing ecosystem.

4. Innovate with Product Offerings

In an industry where one-size-fits-all policies were the norm, Acko stood out by designing micro-insurance and usage-based products tailored to specific situations. From trip insurance that cost a few rupees to hyper-personalized motor insurance based on driving behavior, Acko challenged the traditional model with modular, affordable, and need-based insurance.

This innovation opened up new market segments—especially among younger, mobile-first users—and proved that understanding unmet consumer needs is key to unlocking growth.

5. Navigate Regulatory Landscapes Proactively

Operating in a tightly regulated industry like insurance required Acko to be both cautious and forward-thinking. Rather than viewing regulations as barriers, the team engaged constructively with the Insurance Regulatory and Development Authority of India (IRDAI) to ensure full compliance while still innovating at speed.

This proactive stance helped build institutional trust and avoided delays that could have derailed momentum. For any entrepreneur working in regulated markets, Acko’s approach shows that collaboration with authorities can be a strategic advantage—not just a legal necessity.

Conclusion

Acko’s journey from an ambitious insurtech startup to one of India’s leading digital insurers is a shining example of how technology, consumer empathy, and bold thinking can reimagine legacy industries. At a time when the insurance sector was mired in complexity and mistrust, Acko introduced transparency, speed, and relevance—redefining what customers expect from an insurer. More than just a disruptor, Acko became a category creator, inspiring a wave of digital transformation across the insurance landscape.

For entrepreneurs, Acko’s story offers more than just admiration—it offers a playbook. From building customer-first products to forming high-leverage partnerships, from staying ahead of regulation to innovating with agility, every move made by Acko holds a lesson. In the words of founder Varun Dua, “We didn’t want to sell fear. We wanted to sell trust and convenience.” That mindset, coupled with flawless execution, is what truly set Acko apart.