Paytm Success Story: 5 Fundamental Lessons for Every Entrepreneur

Vivek Goel

May 13, 2025

Table of Contents

Introduction

Once synonymous with mobile recharges, Paytm has evolved into a full-fledged fintech powerhouse — reshaping how Indians pay, save, invest, borrow, and shop online. Founded in 2010 by visionary entrepreneur Vijay Shekhar Sharma, Paytm — short for “Pay Through Mobile” — was born out of the idea that mobile technology could democratize access to digital finance in a country as vast and diverse as India. The company rode the wave of increasing smartphone penetration, UPI adoption, and, most notably, the 2016 demonetization, which accelerated the nation’s shift to digital payments almost overnight.

As of FY 2023–24, Paytm reported over 100 million monthly transacting users, with merchant subscriptions crossing 10 million. The company also achieved a revenue of ₹9,978 crore, marking a 25% year-on-year growth from FY 2022–23. These numbers reflect not just Paytm’s scale, but also its ability to expand into lending, insurance, wealth management, ticketing, and more — all while keeping digital payments at its core.

What makes the Paytm success story stand out is its ability to constantly reinvent itself, take bold technology bets, and maintain an unshakeable belief in India’s digital-first future. For entrepreneurs, Paytm’s journey offers not just business inspiration, but a masterclass in grit, scalability, and calculated risk-taking in a highly competitive and regulated environment.

Origin Story

Paytm was founded in 2010 by Vijay Shekhar Sharma, a small-town boy from Aligarh with big dreams. A computer science graduate from Delhi College of Engineering, Sharma had already launched a mobile content company, One97 Communications, before pivoting to mobile payments. The idea for Paytm came when he observed the growing potential of smartphones in India and realized the gap in mobile-based financial services.

In an interview, Sharma shared:

“When we started Paytm, we were not a payments company. We were solving a problem — how to enable the common Indian to transact with ease on mobile.”

The early version of Paytm started with mobile recharges and utility bill payments, a problem faced by millions. Its wallet launched in 2014, and in 2016 — after the Indian government’s demonetization drive — Paytm became a household name almost overnight.

The company was built on the foundation of Sharma’s core belief that technology should empower the underserved, and that India’s digital leap would come from small towns and villages, not just metro cities.

Business Landscape and Challenges

India’s fintech space is highly competitive and tightly regulated. When Paytm entered the market, digital literacy was low, trust in online payments was limited, and most consumers still used cash for everything. Banks were slow-moving giants, and new-age financial services were considered risky by the masses.

One of Paytm’s biggest challenges was to educate and onboard millions of first-time digital users — often with limited financial knowledge or access to banking infrastructure. Building trust at scale in such an environment required relentless focus on customer support, merchant onboarding, and easy-to-use interfaces.

“Trust is everything. And in a country like India, you can’t just build for the top 10%. You have to solve for the masses,” said Sharma.

Additionally, Paytm had to navigate intense regulatory scrutiny, especially when it expanded into financial services like banking, lending, and mutual funds. Maintaining compliance while scaling rapidly required a strong legal, risk, and tech backbone — something the company invested in early.

Growth Strategies

Paytm’s meteoric rise was fueled by a combination of strategic decisions, external tailwinds, and a deep understanding of Indian consumers. Some of the key growth strategies that propelled Paytm include:

- Demonetization as a Catalyst: In 2016, the Indian government demonetized ₹500 and ₹1000 notes. While the country struggled with cash shortages, Paytm’s wallet became the go-to solution for digital payments — leading to a surge in downloads and usage.

- Merchant-first Approach: Paytm aggressively onboarded small and medium merchants by distributing QR codes, offering zero-cost onboarding, and enabling quick settlements. This created a vast offline-to-online payments network.

- Super App Ecosystem: Unlike companies focused on a single vertical, Paytm built a comprehensive platform offering everything from bill payments and movie tickets to insurance and stock trading. This cross-vertical synergy drove user engagement and retention.

- Strategic Partnerships & Funding: Backed by global investors like Alibaba, SoftBank, and Berkshire Hathaway, Paytm scaled rapidly while also forming alliances with banks, NBFCs, and brands.

- Tech Infrastructure & Data Play: Paytm built robust in-house capabilities around user behavior, data analytics, and AI to personalize offers, drive credit scoring for Paytm Postpaid, and optimize product usage across its suite.

By 2023, Paytm was not just a payments company — it was a full-stack fintech platform, operating Paytm Payments Bank, Paytm Money, Paytm Insurance, and Paytm Lending, among others.

Marketing Strategy

Paytm’s marketing strategy has been deeply rooted in mass-market appeal and utility-driven messaging. It never sold a dream — it sold convenience, safety, and trust.

- “Paytm Karo” Campaign: Launched post-demonetization, this iconic campaign became a cultural phrase. The simple CTA — Paytm Karo — captured the company’s intent of replacing cash with quick digital transactions.

- Localized Outreach: Paytm invested in vernacular content, hyper-local campaigns, and regional influencer partnerships to tap into Tier 2 and Tier 3 markets.

- Merchant Evangelism: Shopkeepers and local vendors became walking billboards for Paytm. Free QR kits, stickers, and cashback programs converted them into brand advocates.

- Trust Through Transparency: While scaling new services like wealth and lending, Paytm made sure to use simple language and education-focused content to build user trust.

- Data-Driven Personalization: With vast consumer data, Paytm personalized notifications, offers, and upsell recommendations to ensure high customer retention and cross-selling success.

In essence, Paytm’s brand was built in the streets, not just on screens.

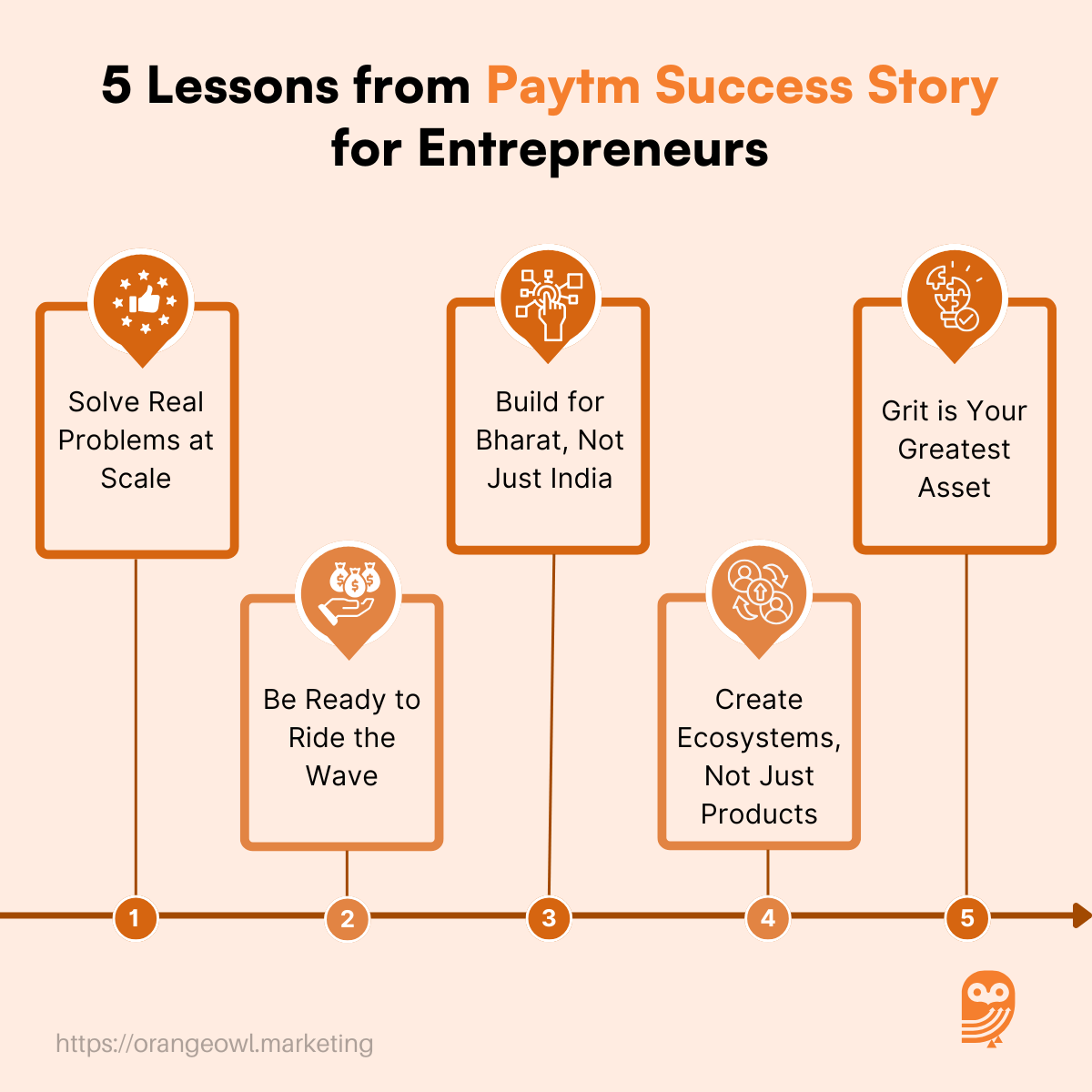

5 Fundamental Lessons for Every Entrepreneur

1. Solve Real Problems at Scale

Paytm’s incredible rise began with something deceptively simple — mobile recharges. At a time when digital payment infrastructure was nearly nonexistent in India, Paytm chose to solve problems that affected the daily lives of millions.

From bill payments to peer-to-peer transfers, Paytm understood that the biggest impact often comes from addressing the most common friction points. This focus on real-world relevance allowed Paytm to build trust and scale rapidly. For entrepreneurs, the takeaway is clear: Don’t chase what’s flashy. Instead, build products that people need, and success will follow.

2. Be Ready to Ride the Wave

The true inflection point for Paytm came in November 2016 during India’s demonetization. With a sudden push away from cash, Paytm was ready with the tech, infrastructure, and brand visibility to fill the void. Its QR-code-based payment system exploded in popularity almost overnight.

While the timing was beyond Paytm’s control, their preparedness allowed them to seize the moment. This lesson is crucial for any entrepreneur: opportunity often appears disguised as disruption. Those who are agile, adaptable, and ready to scale can convert external shocks into exponential growth.

3. Build for Bharat, Not Just India

Founder Vijay Shekhar Sharma has always emphasized the importance of serving the “next billion” users — those in Tier 2, Tier 3, and rural India. Unlike many startups focused solely on urban elites, Paytm prioritized regional language support, offline merchant integrations, and intuitive design for first-time internet users.

This inclusivity was a key differentiator. Entrepreneurs must remember that the real India lies beyond metros — and designing with empathy for that segment not only drives volume but builds true social impact.

4. Create Ecosystems, Not Just Products

What started as a payments app soon expanded into Paytm Payments Bank, Paytm Money (wealth management), Paytm Mall (e-commerce), and Paytm Postpaid (credit services). By solving multiple financial needs within one ecosystem, Paytm increased user stickiness and created multiple revenue streams.

This horizontal expansion wasn’t random — it was a deliberate strategy to capture every financial interaction in a user’s journey. Entrepreneurs can learn from this layered growth: instead of building isolated products, think of how you can build ecosystems that solve adjacent problems and enhance user lifetime value.

5. Grit is Your Greatest Asset

Perhaps the most inspiring aspect of Paytm’s story is Vijay Shekhar Sharma’s personal journey. Coming from a small town and studying in Hindi medium, Sharma initially struggled with English and faced ridicule and rejection. But he persevered — teaching himself English, coding, and business. His unwavering belief in India’s digital potential laid the foundation for a billion-dollar company.

As Sharma famously said in an interview:

“I was rejected, underestimated, and doubted. But I never stopped believing that we can build world-class tech in India for Indians.”

For entrepreneurs, his story is a powerful reminder: ideas matter, but grit and resilience are what truly separate success from failure.

Conclusion: Key Takeaways from Paytm’s Journey

Paytm’s rise is not just a business milestone — it’s a masterclass in vision, execution, and purpose-driven entrepreneurship. What began as a simple recharge platform now sits at the center of India’s digital financial revolution, influencing how millions earn, spend, save, and invest.

The Paytm story offers more than just startup inspiration — it offers a strategic blueprint. Entrepreneurs should note how Paytm combined timing with technology, scaled without abandoning user empathy, and constantly evolved to stay ahead. It proved that innovation in India doesn’t require copying the West — it requires listening to the needs of its people.

As Vijay Shekhar Sharma puts it best:

“You don’t build for exits. You build for impact. And when you solve for the masses, the scale will follow.”

For anyone looking to disrupt traditional markets or build the next big thing, Paytm’s journey is proof that India’s future belongs to those who dare to build it — with purpose, perseverance, and people-first thinking.