CRED Success Story: 5 Valuable Lessons for Every Entrepreneur

Vivek Goel

May 7, 2025

Table of Contents

Introduction

In India’s rapidly evolving fintech landscape, CRED has emerged not just as a service but as a status symbol—redefining how financially responsible individuals interact with credit. Founded in 2018 by serial entrepreneur Kunal Shah, CRED began with a simple yet powerful proposition: reward people for paying their credit card bills on time. What started as a niche loyalty program quickly evolved into a full-stack financial ecosystem, now including offerings like rent payments, credit lines, peer-to-peer lending, and even luxury product marketplaces. As of 2024, CRED is valued at approximately $4 billion, a testament to its cultural and commercial significance in India’s fintech sector.

Behind CRED’s meteoric rise is Kunal Shah’s uncanny ability to understand Indian consumer psychology. Unlike traditional fintech models that chase scale with discounts, Shah focused on building aspirational utility—offering value to the top 1% of India’s creditworthy class. His mission wasn’t just to create another payment app, but to build a trusted club for the financially responsible, turning something as mundane as bill payments into an experience layered with prestige and rewards.

“India doesn’t lack wealth; it lacks efficient distribution.”— Kunal Shah, Founder of CRED

CRED’s story is a unique blend of vision, timing, and product elegance. It challenges the notion that fintech must always serve the masses first, and instead, shows how exclusivity, when done right, can become the engine of inclusivity.

Origin Story

Kunal Shah’s journey as an entrepreneur is a study in second acts and sharper visions. Before founding CRED, Shah had already tasted success with FreeCharge, a mobile recharge platform that revolutionized utility payments in India and was eventually acquired by Snapdeal for $400 million in 2015. But for Shah, this milestone was just the beginning. Post-exit, he spent several years observing macroeconomic patterns, consumer psychology, and the structural inefficiencies plaguing India’s financial systems. What he discovered was striking: despite the rapid rise in digital transactions, trust and credit discipline remained deeply under-leveraged.

Armed with these insights, Kunal Shah launched CRED in 2018, not as another UPI app or loan disbursement tool, but as a trust-based financial club. The idea was daring: create a rewards-based platform exclusively for users with a credit score of 750 and above—effectively targeting the top 1% of India’s creditworthy population. At a time when every other fintech startup was racing to acquire the masses, CRED was deliberately exclusive. It chose depth over breadth, quality over quantity.

The first offering was simple yet game-changing: reward users for paying their credit card bills on time. But underneath that simplicity was a profound insight—people want to feel good about doing the right thing. CRED gamified responsibility, turning what used to be a mundane monthly chore into a gratifying experience, complete with CRED coins, brand offers, and later, cashback and shopping incentives.

By focusing on an elite segment and designing a beautiful, intuitive app interface, CRED positioned itself not just as a fintech tool, but as a luxury product—one that spoke to aspiration, trust, and financial self-esteem.

“In India, we don’t lack talent or ideas; we lack the courage to think big.” — Kunal Shah, Founder of CRED

This courage to think differently, and to start with trust instead of scale, laid the foundation for what would become one of India’s most iconic fintech brands.

Business Landscape and Challenges

When CRED entered the fintech arena in 2018, the dominant narrative was one of financial inclusion. Startups were racing to digitize payments, bring the unbanked into formal financial systems, and scale rapidly across Tier 2 and Tier 3 markets. In stark contrast, CRED took a contrarian path—choosing not to serve the unbanked, but rather the already privileged. It focused on India’s top-tier creditworthy consumers, a segment that was financially active but lacked meaningful rewards or recognition for their responsible behavior.

This strategic choice immediately set CRED apart, but it also invited intense scrutiny. The fintech ecosystem questioned the viability of such a narrow focus. Critics asked, “Why build a product only for the top 1%?” and “Who needs an app just to pay credit card bills?” The platform’s high entry barrier—a credit score of 750+—was labeled exclusionary, and many doubted whether such a limited user base could support a large-scale business.

However, Kunal Shah and his team saw something others didn’t: this elite group of users not only had high spending potential but also demanded trust, sophistication, and premium experiences—qualities most fintech products lacked. Instead of following the crowd, CRED aimed to build trust-first and scale later, crafting a premium app experience that mirrored luxury products, not financial utilities.

To overcome skepticism, CRED focused on three key pillars:

- Tangible Value: Users earned CRED coins every time they paid their credit card bills, which could be redeemed for exclusive offers, cashback, or curated brand experiences. This gamification of financial discipline created a habit loop that made users return every month.

- Elegant Design: From day one, CRED prioritized aesthetics and minimalism. The app interface felt smooth, premium, and effortless—elements that resonated deeply with a user base used to global standards.

- Data Privacy and Transparency: In an industry often marred by trust issues, CRED publicly emphasized its no-spam, no-ads, no data-leakage promise. This focus on ethical data use became a major differentiator.

As adoption grew, so did the ambition. CRED gradually expanded beyond credit card payments into rent payments, CRED Cash (short-term personal loans), CRED Mint (peer-to-peer lending), and wealth management offerings. These services deepened user engagement and diversified revenue streams—transforming CRED from a utility app into a full-fledged financial lifestyle platform.

What began as a simple credit card rewards app soon turned into a trusted financial ecosystem for India’s most financially conscious citizens.

“The biggest risk we took was focusing on trust and exclusivity. But that’s also what made people stay.” — Kunal Shah, Founder of CRED

Growth Strategies

CRED’s meteoric rise in the fintech space didn’t come from aggressive marketing or deep discounting—it came from deep product thinking and a laser-sharp focus on the user experience. Every strategic move was anchored in understanding the aspirations, behaviors, and expectations of India’s creditworthy elite. Instead of chasing scale blindly, CRED focused on building a product that users would genuinely love and talk about.

One of the most important pillars of its growth has been product-led innovation. From the beginning, CRED offered a visually stunning and functionally intuitive platform. The experience of paying a credit card bill—often seen as mundane—was transformed into something delightful. With features like one-click payments, gamified rewards through CRED coins, personalized brand offers, and curated partner experiences, CRED made finance feel less like a chore and more like a privilege. This consumer-first design approach ensured high retention and positive word-of-mouth.

Another powerful growth engine was community building. CRED didn’t try to serve everyone—instead, it created a sense of belonging among those who were financially responsible. The exclusivity of being accepted into CRED became a status symbol. This niche positioning built a tight-knit, high-LTV user base that felt seen, valued, and trusted. In Shah’s words, “People like to be around people like them. CRED is a club of people who do the right things financially.”

CRED also made strategic acquisitions to expand its service offerings and capture more value across the financial journey of its users. The acquisition of Happay enabled CRED to tap into the corporate expense management space, while CreditVidya gave it deeper access to alternative credit scoring and lending infrastructure. Most recently, Kuvera, a wealth management platform, allowed CRED to foray into mutual fund investments and long-term financial planning. Each acquisition was not just a product extension—it was a step toward building a full-stack financial ecosystem.

What truly tied all these strategies together was data-driven decision-making. By deeply analyzing user behavior, CRED personalized its product recommendations, improved reward systems, and ensured that each interaction felt meaningful. Whether it was pushing a rent payment reminder or curating a reward for a high-spending user, CRED used insights to enhance user experience at every touchpoint.

By 2024, these strategies bore significant fruit. CRED expanded its monthly active user base to over 13 million, a remarkable feat for a product that began with a narrow user segment. With new features like UPI integration, CRED Pay for e-commerce, and curated shopping experiences, the company has further increased daily engagement, moving beyond utility to becoming a habit.

“We didn’t grow by shouting louder—we grew by listening better. When you respect your users’ intelligence, they stay with you.” — Kunal Shah, Founder of CRED

Marketing Strategy

CRED’s marketing philosophy has always defied norms—just like its product. Instead of relying on conventional fintech promotions that highlight utility or discounts, CRED focused on creating cultural moments. One of its most iconic moves was its Indian Premier League (IPL) advertising campaigns. These weren’t mere brand plugs—they were mini spectacles. Featuring nostalgic celebrities like Rahul Dravid, Bappi Lahiri, and Jackie Shroff in quirky, unexpected roles, the ads sparked virality and meme culture, turning brand awareness into brand affection.

The genius behind these campaigns lay in self-aware storytelling. CRED didn’t just sell an app—it sold an identity. The humor was niche, the production was premium, and the message was clear: this isn’t a mass product—it’s for those who get it. That subtle elitism, combined with relatability, worked wonders.

Beyond video campaigns, content marketing and thought leadership played a huge role. Kunal Shah’s social media presence—especially on LinkedIn, Instagram, and Twitter—became a direct marketing channel for the brand’s philosophy. He frequently shared insights on consumer psychology, inequality, and behavioral economics, subtly linking these themes back to what CRED aimed to solve. This made CRED more than just an app—it became a brand with a soul and a story.

The brand also relied on community-driven marketing. CRED users themselves became advocates. Whether it was through referrals, social sharing of reward redemptions, or simply word-of-mouth in premium circles, CRED’s community functioned like its first marketing team. Trust, exclusivity, and usefulness became its strongest promotional levers.

“Our community was our first marketing team. When you solve a real need well, users do the promotion for you.” — Kunal Shah, Founder of CRED

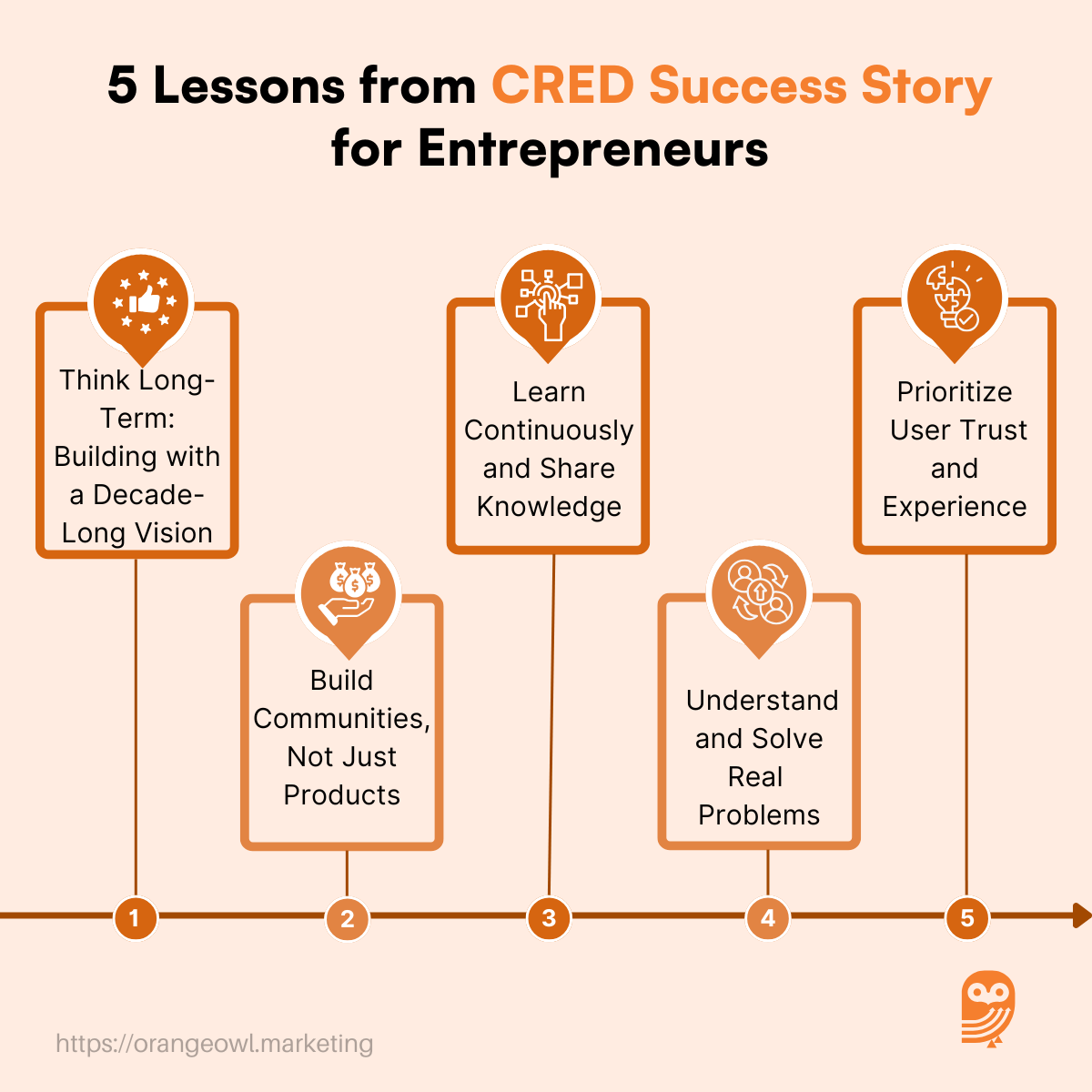

5 Valuable Lessons Every Entrepreneur Should Learn from CRED

1. Think Long-Term: Building with a Decade-Long Vision

One of the most defining aspects of CRED’s journey is its unwavering commitment to a long-term vision. Kunal Shah didn’t build CRED for quarterly wins or viral stunts—he designed it with a 10-year lens. In a world obsessed with rapid growth and quick exits, this patience is rare and powerful.

By focusing on brand trust, product depth, and consistent user experience over time, CRED established itself as a premium fintech platform with lasting impact. Entrepreneurs can learn that true value creation often lies in pacing growth wisely, and in delivering compounding benefits over time, rather than short-lived gains.

“If you’re playing a long game, you don’t chase vanity metrics—you build fundamentals.”

— Kunal Shah

2. Build Communities, Not Just Products

CRED isn’t just a fintech product—it’s a high-trust ecosystem. By targeting financially responsible users and offering curated rewards, CRED created a space that felt like a club. This sense of belonging cultivated emotional loyalty—a rarity in transactional apps.

From exclusive offers to early access features, users felt seen and valued. The takeaway for entrepreneurs is clear: loyalty isn’t bought with discounts; it’s earned through identity and experience. If you can build a product that people want to associate themselves with, you’re no longer competing—you’re cultivating.

3. Learn Continuously and Share Knowledge

Despite being one of India’s most successful tech entrepreneurs, Kunal Shah remains relentlessly curious. He reads voraciously, studies human behavior, and actively shares his learnings through interviews, lectures, and social media.

This not only helps him grow as a leader but also positions him as a thought leader in the startup ecosystem. Entrepreneurs should take inspiration from this intellectual humility. The market changes fast, and those who stop learning get left behind. Moreover, sharing knowledge builds trust, credibility, and influence—all invaluable assets in business.

“The more you understand humans, the better products you can build.”— Kunal Shah

4. Understand and Solve Real Problems

CRED was born from a simple yet overlooked problem: Why aren’t financially responsible people rewarded? This insight led to a product that flipped the traditional narrative of financial services. Instead of penalizing users for bad behavior, CRED celebrated good behavior.

The result? A product that filled a real gap and resonated deeply with its target audience. Entrepreneurs should focus on solving real, underappreciated problems. Chasing trends might offer temporary attention, but addressing pain points creates lasting demand.

5. Prioritize User Trust and Experience

Trust is the backbone of any fintech venture—and CRED treated it as sacred. From a minimalist UI to transparent policies and frictionless navigation, every design and tech decision was made with the user in mind. The app didn’t just function well; it felt premium.

This attention to micro-interactions and user emotions set CRED apart. For entrepreneurs, the message is clear: Design isn’t decoration—it’s a strategy. And when you combine great design with consistent delivery, you build something priceless: user trust.

Conclusion: Key Takeaways from CRED’s Journey

CRED’s rise in the Indian fintech ecosystem isn’t just a story of scale—it’s a blueprint for intentional, thoughtful entrepreneurship. The company didn’t aim to win through noise or aggressive growth hacks. Instead, it focused on solving a nuanced problem with precision, clarity, and long-term thinking. This journey underscores five core principles every entrepreneur should embrace: build with a decade-long vision, create communities not just products, keep learning, solve real user pain points, and prioritize trust above all else.

Kunal Shah’s leadership highlights that disruption doesn’t always come from being first—it comes from being right. His approach to value creation, steeped in behavioral insight and business fundamentals, has helped CRED redefine how premium products can emerge even in a cost-conscious market like India.

“As entrepreneurs, the only currency we have less of is time. So it is best to go prepared.” — Kunal Shah

For today’s founders and dreamers, CRED is more than just a fintech success—it’s a reminder that clarity of purpose, user empathy, and deep conviction can build not just a business, but a legacy.