Perfios Success Story: 5 Impactful Lessons for Every Entrepreneur

Vivek Goel

May 6, 2025

Table of Contents

Introduction

In the world of financial technology, Perfios stands out as a pioneer that has quietly yet profoundly transformed how financial data is accessed, analyzed, and used across the lending and wealth management ecosystem. Founded in 2008 by seasoned tech entrepreneurs V R Govindarajan and Debashish Chakraborti, Perfios began with a simple but powerful mission: to infuse intelligence and automation into a sector long dominated by manual workflows, complex paperwork, and fragmented data systems.

What started as a consumer-focused personal finance tool quickly pivoted into a robust enterprise-grade platform—now forming the backbone of credit assessment, income analysis, and fraud detection workflows for banks, NBFCs, fintechs, and wealth advisors. Over the past 15 years, Perfios has scaled into a global financial data powerhouse, catering to more than 1,000 financial institutions across 18 countries, including major markets in India, Southeast Asia, and the Middle East.

Perfios’ platform processes over 1.7 billion data points monthly, enabling real-time decisioning in areas such as digital lending, onboarding, financial underwriting, and regulatory compliance. These figures aren’t just marketing fluff—they reflect a mission rooted in scale, security, and seamless API integration.

“Our aim from the beginning was to enable faster, data-backed decisions for financial institutions, without compromising on accuracy or compliance.”— V R Govindarajan, Co-founder & CEO

Perfios has become the silent engine behind India’s digital lending revolution—offering not disruption, but empowerment.

Origin Story

Perfios was born out of a sharp realization that the financial services industry was desperately in need of modernization. In 2008, co-founders V R Govindarajan and Debashish Chakraborti, both with rich backgrounds in enterprise software (including stints at Aztecsoft and other tech ventures), observed that financial institutions were still relying on manual documentation, physical verifications, and outdated systems to assess creditworthiness. This inefficiency slowed down lending processes and introduced higher risks of fraud, errors, and data loss.

Initially, Perfios started as a personal finance management tool, helping individuals track income, expenses, and investments. However, the founders soon recognized a far greater opportunity on the institutional side. Banks, NBFCs, fintechs, and even wealth advisory firms were struggling with fragmented, unstructured financial documents that slowed down decision-making. That’s when the pivot happened—from B2C to a full-scale B2B SaaS platform for financial data aggregation and analysis.

This pivot proved to be a game-changer. Perfios developed proprietary AI-driven engines capable of extracting and normalizing data from multiple formats—PDFs, images, XMLs, spreadsheets—and turning them into real-time insights. Whether it was bank statements, tax returns, income proofs, or GST filings, Perfios made the data accessible, verifiable, and actionable.

“We didn’t want to replace banks—we wanted to empower them.”— Debashish Chakraborti, Co-founder

By taking on the “grunt work” of data processing, Perfios allowed financial institutions to focus on faster, smarter, and more secure decision-making. What began as a humble tool for individuals evolved into a mission-critical infrastructure provider for the entire financial services ecosystem.

Business Landscape and Challenges

Navigating the complex world of Banking, Financial Services, and Insurance (BFSI) is a daunting task—especially for a tech-first startup aiming to modernize deeply entrenched legacy systems. When Perfios entered the space in 2008, the financial sector was not known for its openness to change. It was a time when most banks operated with on-premise infrastructure, manual underwriting processes, and a heavy reliance on paperwork. The very idea of digitally accessing, parsing, and analyzing sensitive financial data via cloud-based APIs seemed like a risk rather than an opportunity to most stakeholders.

One of Perfios’ earliest and most persistent challenges was earning trust—not just from private lenders, but also from regulatory bodies like RBI, SEBI, and various financial watchdogs. Convincing traditional financial institutions to share sensitive documents like tax returns, income proofs, and bank statements through automated systems required not only cutting-edge technology but also psychological reassurance. Data privacy, security, and compliance were non-negotiable.

To address these concerns, Perfios adopted a zero-compromise approach to data governance. It built its platform with enterprise-grade end-to-end encryption, audit trails, role-based access controls, and secure APIs compliant with regulations like ISO/IEC 27001, SOC 2, and local Indian IT laws. Their products were designed to be plug-and-play, minimizing disruption to existing IT stacks, while their integration and support teams worked closely with clients to ensure smooth adoption.

“Earning trust was more important than closing sales. We had to educate and collaborate, not just sell software.” — V R Govindarajan, Co-founder & CEO

Despite operating in a traditionally slow-moving sector, Perfios demonstrated steady traction. Its solutions were not just helpful—they became mission-critical, enabling digital lending platforms to automate KYC, income analysis, fraud detection, and creditworthiness assessments.

The company’s resilience and client-first approach culminated in a major milestone in 2023, when Perfios raised $229 million in Series D funding led by Kedaara Capital. The funding was not just a capital infusion—it was a resounding validation of the company’s scalability, profitability, and long-term vision. It also set the stage for global expansion and further innovation across lending, wealth management, and insurance sectors.

Growth Strategies

Perfios’ growth journey is a masterclass in deep specialization and scalable infrastructure. Instead of trying to solve every financial services problem at once, the team zoomed in on critical bottlenecks—like manually verifying bank statements, assessing income profiles, and detecting inconsistencies in financial documents. They tackled these challenges with precision, building AI- and ML-powered engines that could automate and standardize workflows traditionally handled by large underwriting teams.

The company’s product strategy was modular by design. Through an API-first approach, Perfios introduced products like:

- Perfios Connect – to securely fetch financial data from multiple sources.

- Perfios Insight – to analyze and interpret structured and unstructured financial data.

- Perfios DecisionHub – to automate and streamline credit decisioning using rule engines and data scoring models.

This modularity gave banks, NBFCs, and fintechs the ability to adopt what they needed, when they needed it—without overhauling their tech stack. Whether it was a digital-first lender in Mumbai or a microfinance firm in Indonesia, Perfios could serve them with agility and precision.

“We built Lego blocks, not monoliths. That’s how we scaled across so many verticals and geographies.”— Debashish Chakraborti, Co-founder

A significant milestone in Perfios’ growth trajectory was global expansion. After establishing a stronghold in India, the company strategically entered Southeast Asia, the Middle East, and Africa—regions where credit infrastructure was underdeveloped but digital adoption was on the rise. These markets mirrored India’s financial data challenges, allowing Perfios to plug in its existing solutions with contextual tweaks.

As of 2024, Perfios has facilitated over 150 million credit and loan decisions annually, impacting use cases in retail lending, SME underwriting, wealth tech, and even insurance. With over 1.7 billion data points processed each month, the company has firmly positioned itself as the financial data backbone for digital finance.

Marketing Strategy

In contrast to the flashy, consumer-first marketing common in fintech, Perfios embraced a trust-first, ecosystem-led marketing approach. Their core audience—CIOs, CROs, and compliance heads—cared less about brand slogans and more about security, reliability, and regulatory fit. So Perfios focused on building domain authority instead of visibility.

They published white papers on risk automation, delivered case studies highlighting performance gains at client institutions, and participated actively in regulatory sandboxes. This not only showcased their tech but also reinforced their commitment to compliance and ethical data practices.

“Our marketing was proof-of-work. If we helped one bank succeed, five more would call us.” — V R Govindarajan

Perfios also forged deep partnerships with key ecosystem players, including:

- Credit bureaus (CIBIL, Experian, CRIF)

- Account Aggregators

- GST Network (GSTN)

- India Stack components like Aadhaar and UPI

By integrating early with these platforms, Perfios made itself indispensable in the data supply chain of digital lending.

Their visibility in industry forums, BFSI conferences, and fintech alliances helped them become the go-to partner for banks undergoing digital transformation. Instead of paid media, word-of-mouth referrals, RFP wins, and multi-year contracts became their main growth drivers.

In short, Perfios didn’t just market a product—they built an ecosystem reputation based on performance, compliance, and trust.

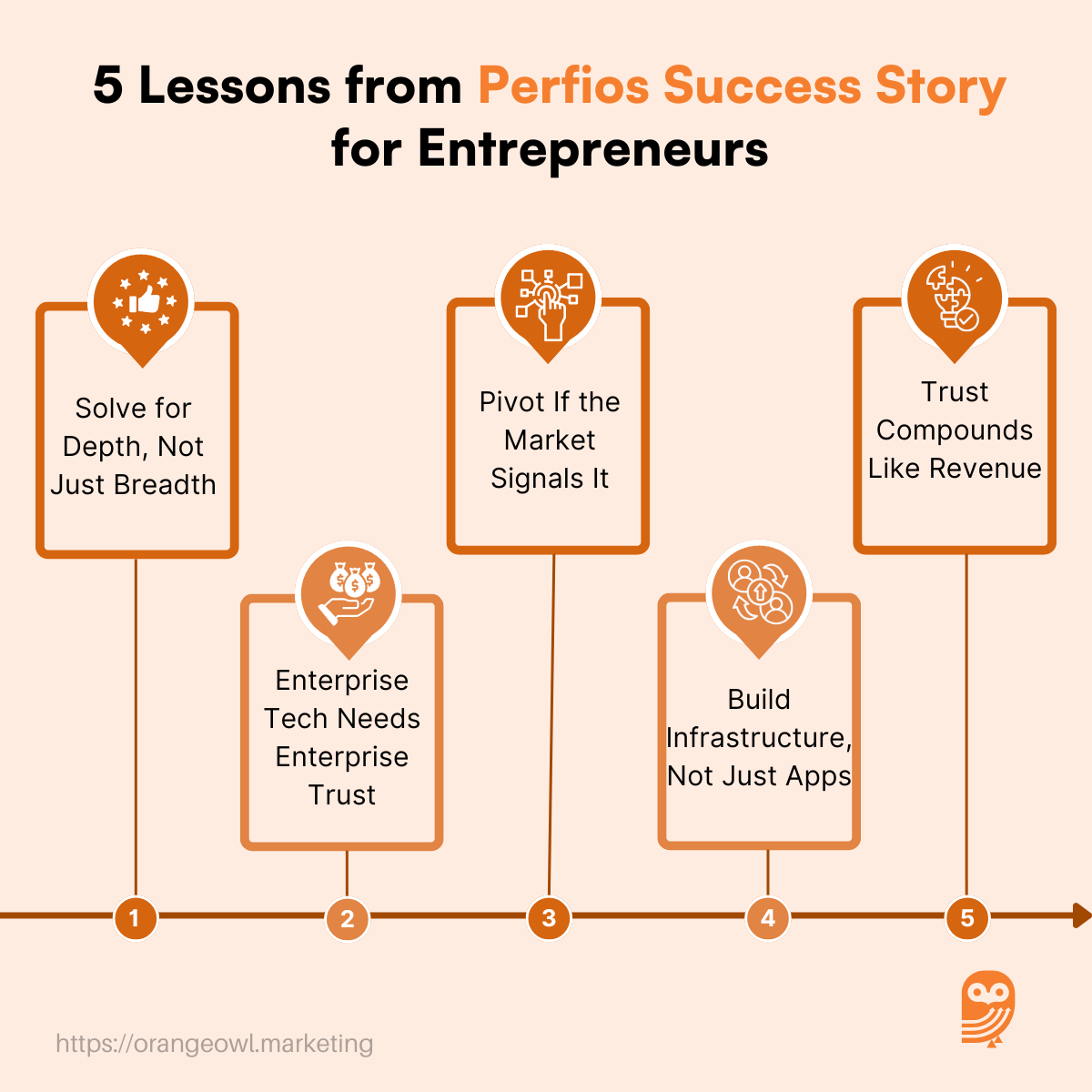

5 Impactful Lessons Every Entrepreneur Should Learn from Perfios

1. Solve for Depth, Not Just Breadth

One of Perfios’ most strategic decisions was to go deep before going wide. Instead of building dozens of features at once, the team focused relentlessly on perfecting core capabilities like bank statement parsing, document analytics, and income verification. These weren’t glamorous use cases—but they were mission-critical for banks and NBFCs.

This laser-sharp specialization created immense product stickiness. Once integrated into a lender’s risk workflow, Perfios became almost irreplaceable. The result? Higher retention, deeper client engagement, and a strong competitive moat.

The takeaway: In the enterprise world, mastery trumps variety. Solve a hard problem end-to-end before expanding into adjacent areas.

2. Enterprise Tech Needs Enterprise Trust

Selling to BFSI isn’t about flashy UX or clever branding—it’s about earning trust at every layer. Perfios recognized this early. They secured ISO certifications, underwent regular penetration testing, and aligned their systems with RBI guidelines and global data protection standards.

They didn’t just comply with regulations—they made compliance a part of the product DNA. This proactive stance reassured clients that Perfios was a partner, not a liability.

Entrepreneurs building in regulated industries must understand: Trust is not a feature. It’s the foundation.

3. Pivot If the Market Signals It

Perfios didn’t begin as an enterprise software company. It started as a B2C personal finance tool, helping users understand their spending patterns. But when the founders realized that banks were the ones struggling with financial data, they made the hard call to pivot toward B2B.

The shift wasn’t easy—it meant rethinking the product, hiring different talent, and changing the go-to-market strategy. But it unlocked the scalability they needed to build a unicorn.

“We were okay changing direction, as long as the mission stayed the same.”

— Debashish Chakraborti, Co-founder

The lesson here is timeless: Product-market fit often lies beyond your original idea. Stay flexible and listen to the market.

4. Build Infrastructure, Not Just Apps

Perfios succeeded because they didn’t try to replace banks—they enabled them. Rather than pushing disruptive, standalone apps, they built tools that seamlessly integrated with core banking systems, credit bureaus, and APIs within the India Stack.

This infrastructure-first mindset helped them avoid friction with stakeholders. Banks could adopt Perfios without overhauling their legacy architecture—making the decision to onboard easier and faster.

For enterprise entrepreneurs, this is gold: If you want to scale, play well with the systems already in place.

5. Trust Compounds Like Revenue

In B2B, every secure transaction, every uptime commitment met, and every positive client outcome adds to your brand capital. Perfios grew largely without traditional marketing, because their work spoke for itself. One successful deployment led to referrals, which led to RFP wins, which led to multi-year contracts.

They treated every client engagement as a trust-building opportunity—and over time, this invisible asset became their biggest differentiator.

The final lesson: In enterprise, trust scales faster than ads. Focus on delivery, and the reputation will follow.

Conclusion: Key Takeaways from the Perfios Journey

Perfios isn’t just a fintech unicorn—it’s a masterclass in building with purpose and precision. In a space traditionally dominated by paper trails, compliance hurdles, and skepticism toward change, Perfios introduced quiet innovation that earned trust, not noise. What began as a humble attempt to simplify financial document tracking evolved into the digital spine for modern lending infrastructure.

From enabling real-time credit underwriting to supporting global expansion into Southeast Asia and the Middle East, Perfios has shown that you don’t need to disrupt industries with fanfare—you can transform them with focus, integrity, and consistent delivery.

“We’re not here to make headlines—we’re here to create a financial backbone for the future.”— V R Govindarajan, Co-founder & CEO

Their story reinforces some timeless entrepreneurial truths: that specialization scales, that trust is a long-term currency, and that pivots are a strength, not a weakness, when rooted in insight. In a world of overnight hype, Perfios stands out for its decade-long discipline and ecosystem-first philosophy.